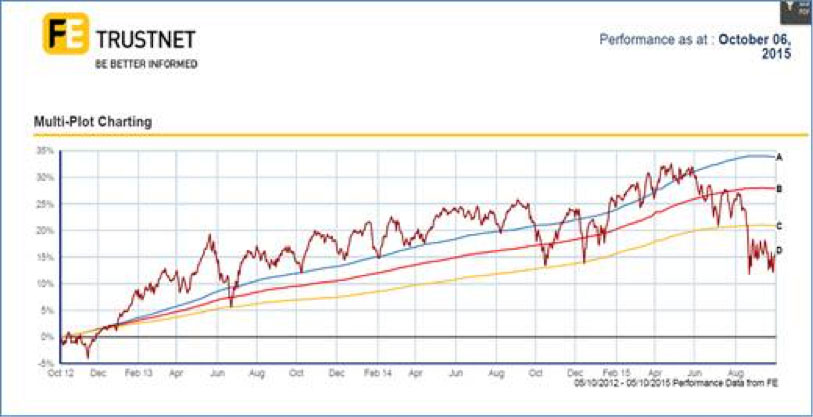

The past 12 months have been turbulent – just take a look at this chart of the FTSE 100 over the last year. There have been some points which I’m sure would have caused your clients some concern, and possibly even had them looking for an alternative investment with reduced volatility; perhaps without reducing their growth potential?

It’s all about the timing

When a market falls and an investor exits, it can then take their funds years to recover. A market drop of 20% means that they will have to recover 25% to reach parity, not including income taken.

For those approaching retirement when prices fall, the future isn’t so rosy.

Smoothing out the risks

Market upheaval can unsettle clients, their jitters can cause them to consider encashing their pension fund before they should. Wouldn’t your clients want to know if there was an alternative?

2014 saw a unique marriage of expertise; LV= and Columbia Threadneedle have created a range of multi-asset funds– the LV= Flexible Guarantee Funds (FGF).

Originally intended as a pure investment vehicle, the LV= FGF funds have proved to be more popular with advisers and clients than we could have anticipated. Many are opting to include them as a pension investment option within their LV= SIPP.

About the LV= FGF

There are three FGF Funds:

All are multi asset and risk-rated by Distribution Technology.

The FGF Funds should be considered in any pension investment portfolio:

Each of the funds have a built-in smoothing mechanism spanning a 26 week period, which can help to ‘smooth’ out market volatility.

Fig: Offset market volatility. Demonstrating the impact of smoothing. FTSE100 v the 3 FGF funds since October 2012.(Source – Trustnet)

The LV= Flexible Guarantee Fund range can also be the perfect bridge into retirement.

The LV= FGF Bridge is the simple way for you and your clients to consider, select and purchase the most popular LV= blend of retirement income solutions.

We have packaged two of our award-winning products within a single SIPP Pension wrapper:

- The LV= Protected Retirement Plan is our fixed term annuity and provides a secure income over a set term, with a guaranteed value at maturity. It’s this element of the plan which provides your client with a secure income for the duration of the term.

- The LV= Flexible Guarantee Funds are our range of 3 with profits fund choices (Cautious Series 2, Balanced Series 2 and Managed Growth), and have a variety of flexible guarantee options and the potential for mutual bonuses to be paid (in addition to the usual returns).

It’s this element of the plan which provides your client with the potential capital growth, allowing them more retirement options at the end of the term.

Here’s more of the detail about the guarantee options and the mutual bonus:

Guarantee Options

Help protect against downside investment risk with the LV= FGF Guarantee, which you can add or remove at any time. It provides your clients with peace of mind by giving them the opportunity to ‘lock in’ their original investment or additionally during the term, any investment gains, and secure this part of their future pension fund value, up to a known date.

LV= Mutual Bonus

On top of any growth from the fund we aim to pay a 1% bonus to all of our members each year – and have done so since the Mutual Bonus was launched in 2011. Mutual Bonuses cannot be guaranteed and in exceptional circumstances can be taken away.

If you would like information about LV=, you can visit our website or for more information on our FGF finds visit or call the LV= Retirement Desk on: 0800 023 4178.