A default investment fund is a selection of investments that employers invest into on behalf of employees who do not wish to make their own investment choices within a defined contribution (DC) pension scheme.

If you read nothing else, read this…

- A default investment strategy should be created to help employees who do not want to make active choices about their pension investment.

- A strategy should take into account an organisation’s demographics, such as age, likely retirement age and contribution levels.

- The pension freedoms, which came into effect on 6 April, have made it vital to have clear default investment strategies.

Default investments are designed for staff who do not want to make active choices about their investments, and are a legal requirement for pension schemes used for auto-enrolment. A default investment strategy must reflect the risk profile of the workforce. An effective strategy will also focus on providing employees with effective communication about investments and how the new pensions legislation might affect them.

David Adkins, chief investment officer at The Pensions Trust, says: “Most employees do not understand or want to understand pensions and investments, so they need someone they trust to do the hard work under the bonnet.”

Creating a default investment strategy

The key components of a default investment strategy are good governance and administration, and employers must also ensure the charges are reasonable for employees. A strategy is designed to meet the needs of the majority, so employers need to ensure they make solid investments on behalf of staff. A default option should strike a balance between risk and potential for growth.

A strategy also needs a clearly defined objective. It should detail how it will manage risk and what the expected outcomes are for employees. It also needs to reflect the diverse demographic and needs of a workforce. Nicola Davis, pensions and benefits specialist at law firm Ashurst, says: “It is necessary to understand the demographics and characteristics of those who will use the default investment strategy. So ages, term to retirement, salaries and likely levels of contribution will all help to assess their expected risk preference, and allow for the appropriate balance of risk and return.”

The type of pension scheme an employer operates will help to determine its default fund strategy. Steve Charlton, DC proposition manager, Europe, at Vanguard, explains: “With contract-based schemes, providers will often build the default fund or a small choice of them based on what they think is best for the demographic they expect to attract.

“If the scheme is trust based, trustees will hold the responsibility for the design, implementation and ongoing monitoring. This task allows the trustee to better understand the profile of employees, their level of engagement and their understanding of financial matters.”

Retirement planning

Default investment strategies should help employees align their savings with their retirement expectations. Therefore, employers need to educate staff about the importance of planning for a steady retirement income.

John Lawson, head of policy and retirement solutions at Aviva, says: “As retirement approaches, default funds need to deliver for members. Particularly given the pension freedoms, employers need to consider the varied options employees have.”

With the influence of auto-enrolment and the pension freedoms that came into effect on 6 April, employees need to have a good grasp on funding for their retirement plans. This could hike up the need for greater understanding of default funds and the objective behind a strategy. Now, workers are able to cash in their pension if they are aged 55 or over, and can choose between purchasing an annuity, taking regular chunks from their pot or cashing it in at once.

Charlton says: “Trustees and employers now need to figure out what they are providing a default fund for, and an annuity may not be the best option. This is because employees could be taking a drawdown or taking their pot out as cash, and it may get to the point when employees do nothing and have a generic default strategy.”

Communicating a default investment strategy

Communicating a default investment strategy is essential to boost employees’ understanding of pensions, and why they may have been gone into the default option. Adkins says: “Employers need to pitch the strategy to those who don’t want detail about it, as well as those who do. Something like a one-page guide for those less interested and links to more information for members who want to find out more work really well.”

Communication can be driven by an employer’s knowledge of its workforce. Jerry Moriarty, chief executive officer at the Irish Association of Pension Funds (IAPF), says: “Communication is so important. One-to-one communication in particular can really help employers keep default funds simple and focused on the decisions employers are likely to make. It comes down to knowing employees well, whether their pension is their only investment and what their salary is.”

Employer involvement

Once it has been set up, a default investment strategy needs to be managed and watched over by the employer, as well as a trustee, intermediary or provider, to ensure the objective is being met. As Adkins says: “An ideal strategy will make decisions easy for members who do not have investment knowledge.

“Some active management of a default investment strategy is desirable; employers cannot leave it on autopilot. Reminders to employees will make it more appealing too.”

Case study: Telent engages staff with pensions via default investment strategy

Technology service organisation Telent engaged its 1,600 employees with pensions and savings through its default investment strategy.

Since it was introduced in April 2013, its contract-based defined contribution (DC) scheme has achieved 95% take-up. Telent closed its defined benefit (DB) pension to new members in 2007 and to future accrual in 2012.

Telent closed its defined benefit (DB) pension to new members in 2007 and to future accrual in 2012.

Additionally, 95% of Telent staff are also in the default investment fund.

Pete Harris, director of pensions at Telent, explains that the organisation set clear objectives for its default investment strategy: “We knew we’d get high take-up with such a required product, and wanted to implement something useful for our people.”

“In setting up the strategy originally, we were aware that a lot of staff would be used to having DB pensions and not have the skillset to manage a DC pension. We aimed to provide something that would get people to the right place using general terms. We therefore chose a fairly standard lifestyle profile.

“In 2013, we were aware that employees were making less choice for themselves than even we had anticipated.”

Telent opted for the Standard Life Strategic Active Lifestyle Profile III for its default investment strategy. Harris says: “It gives access to a wider investment universe, and to active fund management skill, and risk is actively managed. It can be modified as legislation changes, which has been very beneficial with the arrival of freedom and choice.”

In terms of how Telent highlighted the strategy to staff, Harris says: “I’m a firm believer in face-to-face communication, and feel it’s best to constantly remind employees what is offered to them.”

Telent held roadshows, in conjunction with Standard Life, to communicate the scheme to staff at its office locations, including Basildon, Camberley and Warwick, in April 2013, and in September 2013 when staff were auto-enrolled.

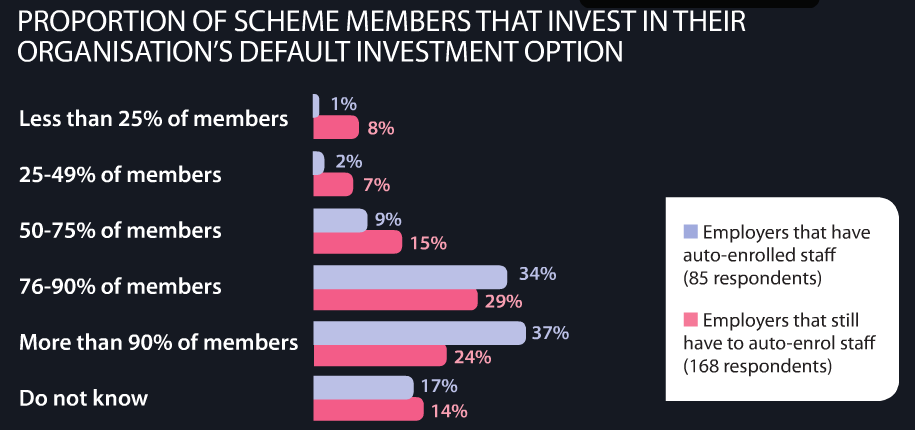

(Source: Employee Benefits/Capita Pensions research 2013 , July 2013, 370 respondents)