The number of pension schemes offering matching pension contributions for members has risen by around 100% in the past 10 years, according to research by Towers Watson.

Its FTSE 350 DC pensions survey 2014, which questioned 98 FTSE 100 and 241 FTSE 350 companies, found that 75% of respondents now offer matching contributions. However, while there has been a moderate increase in contribution levels, these have not kept pace with increasing longevity.

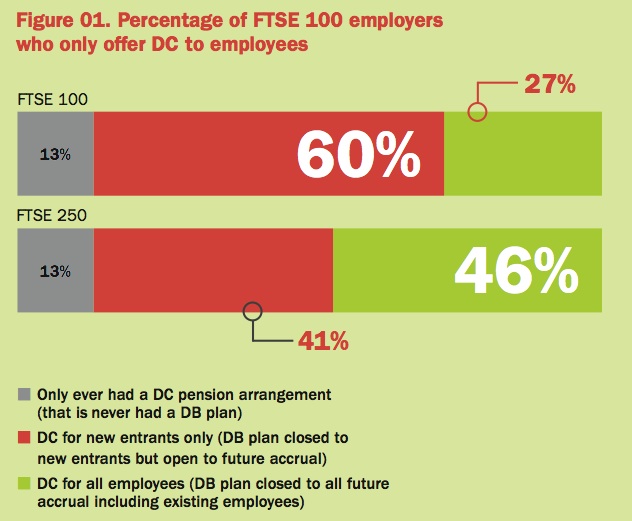

The research also highlighted how the types of pension schemes offered by employers has changed. Defined contribution (DC) pension schemes remain the most common pension in the FTSE 350, offered by 97% of this group.

Over the past 10 years, the percentage of FTSE 350 companies that provide trust-based pensions has fallen, from 68% to 35%.

Meanwhile, no FTSE 100 respondents now use a final salary pension scheme as their primary pension. In 2005, one in five employers operated an open DB scheme.

Alongside their primary pension scheme, 80% also provide employees with share schemes, 14% offer other workplace savings options and 31% offer self-invested personal pensions.

Of the respondents that have automatically enrolled employees, 93% said no more than one in ten employees have opted out.

Pension scheme charges have fallen over the last few years, with the average now well below the 0.75% charge cap set by the government.

In 2009, 6% of FTSE 100 pension schemes had an annual management charge higher than 0.7%. In 2014, this has decreased to 0.3%.

Three-quarters (75%) of FTSE 100 companies offer annuity broking services to help retirees shop around for their best option at retirement.

Some 43% of respondents issue employees with countdown-to-retirement guides, while 66% offer pre-retirement counselling sessions.

Will Aitken (pictured), senior DC consultant at Towers Watson, said: “The results are relevant to any employer with a DC pension.

“They illustrate how the pension market is moving from defined benefit to DC, from passive equity to diversified growth funds, and towards more flexibility in contributions and retirement.

“The flexibility offered by the Budget may push this trend towards flexibility further. If DC pension plans become saving vehicles, giving employers visibility of other savings vehicles alongside pensions may be a logical next step.”

moUupS7tZ3 GQUodsS9U4   <a href=http://dns-www.employeebenefits.co.uk > moUupS7tZ3 GQUodsS9U4 </a>

????????????????????????????????????????????????????????????????????????????

?????? ?

chanel ????????

??? ??

?????? ???

????????????

???? ??? ??

????????????????? ??

mcm ??

chanel ??

???? ???

???????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

celine ?????

gdo ???

???? ????

gucci ??? ??

?????? ???

??????selma riding boots

?????? ??????

?????? ??

chanel ?????? ???

??? ??????

http://www.dbfc17.fr/wp-content/uploads/2013/08/jpbags/neujp1003.htm

Gucci LV jp sale

Ray Ban SunglassesRay-Ban has been the world’s best-selling sunglasses brand. Support this achievement is the Ray-Ban consistently high quality and elegant design. Ray Ban sunglasses are fashionable for women to wear in the summer, beautiful, when you are driving a car in the summer, wearing Ray Ban sunglasses you will get a better visual experience.They use the hormone laboratory, as well as wood products.Ray Ban Outlet Sale They are usually used as well as in winter sports activities, with boating.Ray Ban sunglasses are selling hot, Ray Ban sunglasses sale, to meet the needs of different reflective coating.

http://www.comune.lanciano.chieti.it:8080/entra/Immagini/Ray-Ban-Sunglasses.jpg

Ray Ban Outlet StoreStylish appearance and fashion style, it will be your good choice.Ray Ban is a leading multinational companies committed to providing products to consumers in over 100 countries / regions.If, as the great majority of the many women, you will no doubt be such as texture and shows the fashionable glasses and the fact that attention. One is definitely an excellent dietary supplement in the latest accessories direction.A specific polarization Ray Ban shades with contact lenses help to reduce the glare:Ray Ban Sunglasses Outlet It is important, retailers typically do not overlook the purchase of children’s funds involve Ray Ban tone.Since the Ray Ban Sunglasses Outlet sterling silver triangular mark is considered the most desired status symptoms within the custom entire world while offering widened into accessories including their notable Ray Ban tones.

Ray Ban Sunglasses Sale In the early 90s the Wayfarer became unpopular once again. The design was changed a little to launch a new model of Ray Ban Glasses Wayfarer and to make the best selling design popular again. In 2001 a new redesigned model of Wayfarer with the code name RB2132 was launched. The frame was made lighter than the previous model and the type of the lens was also changed to give it a more stylish look. The sunglasses promises-Be different from in the prosperous occupation-from the ill success ground the stock that expel them.Successful model from recently year of Be packed to can as a result is still disheveled hair now and be sold in this same price is last a year.Make to get angry a special personality of arrows to be spreading widely for 2012 summers in. At optics of Doron, you can seek for 1920 ageses-personalities, composings, 1950 ages drive 1970 ages, the expression arises of be like feline of airplane pilot’s sunglasses and other round structure of same structure, 1960 ageses-personalities.Cheap Ray Ban Sunglasses

The traditional rayban aviators can range anywhere from 119 to 179 depending the type if lense.Discount Ray Ban Sunglasses You can get them at any sunglass Hut store or Macy’s or you can go to the sunglass Hut outlet if there is one by you. They come in different sizes and different lense shades, the best thing to do is just to go to a store and try them on. Choose increased UV protection when you hike in the snow, participate in any winter sports that take you onto the reflective surfaces of snow or ice, or enjoy water sports.Ray Ban Sunglasses Online The best sunglasses for eye protection in these settings are wraparound styles and goggles that offer allaround protection of the eyes.

Ray Ban WayfarerRay Ban Aviator