In the digital age, organisations are adopting the latest technology to streamline a whole range of business processes, one of the latest being their employee benefits administration.

If you read nothing else, read this…

- A good software system can eliminate the need for a dedicated benefits administration function and alleviate much of the admin burden from HR.

- When choosing a system, employers should opt for cloud-based providers that offer services that can be integrated into an existing HR system that are least likely to disrupt business or IT functions.

- In an age of multi-generational workforces, employers should choose a technology-based benefits system that offers something for all members of staff.

The benefits market is packed with sophisticated technology platforms, cloud-based systems and software that promises to take the hassle out of time-consuming, outdated, paper-based processes.

All well and good, the finance director may say, but where exactly is the reduction on the admin burden and where are the cost savings?

Matthew Gregson, consulting director at Thomsons Online Benefits, says there are some key characteristics of organisations and benefit programmes where the admin burden tends to be high.

“Acquisitive [organisations] that haven’t harmonised benefits, those with traditional occupational pensions and those with complex auto-enrolment populations all tend to struggle with either high internal overheads or large external outsourcing fees, which may not hold up against platform costs,” he says.

“To look at it the other way around, [employers] with a good human capital management [HCM] technology strategy and mature HR organisation tend to have no dedicated benefits administration [function], as a dedicated platform and strong systems integration reduces the burden by up to 85%.”

Cost savings can vary enormously, depending on the size of the organisation and how proficient its benefits administration system was beforehand, but broadly speaking if the typical ratio of full-time HR professionals to staff is 1:100, experts estimate that some HR software solutions can reduce this to 1:140, potentially saving employers tens of thousands of pounds annually.

For example, music licensing firm PPL saved around £10,000 and boosted employee engagement after introducing a new benefits technology system. The organisation implemented the new software system after discovering it was wasting around 5% of time on a number of administration tasks, which was affecting staff productivity levels as well. The software has made routine tasks such as holiday records and training information fully automated and paper free, and provided staff with access to individual payroll, bonus and benefits information and more online.

Multitude of benefits software available

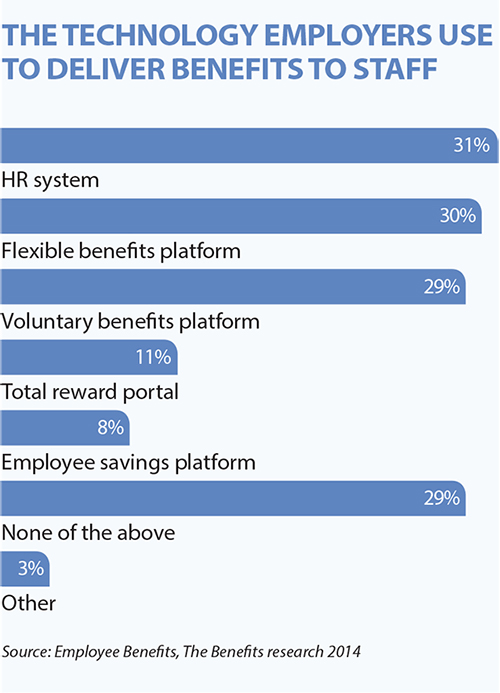

When it comes to choosing benefits software, there are options available for almost every type of employee benefit, from traditional hosting to modern cloud-based solutions.

Any decent software will bring administrative benefits to every organisation with more than a handful of employees, says Adam Sidbury, director of software specialist Digital Fibre. “The complexity kicks in when [employers] try to select the most appropriate benefits for [their] business and tie together all of the different providers’ software,” he says.

Unfortunately, there is no simple answer to this, nor will a provider for everything ever exist, because new services are popping up all the time. The best route is to select modern, nimble, cloud-based providers that offer services that can be integrated into an existing HR system that will neither disrupt a business nor give the IT team a headache, says Sidbury.

According to Martin Thompson, director and head of benefit consulting at Premier Pensions Management, one of the biggest developments in benefits technology is the evolution of mobile-enabled systems.

“Staff expect to be able to access the technology 24/7, and mobile is the obvious way to achieve this,” he says. “The use of nudge techniques to send relevant messages to a segmented workforce will also become the norm. From a cost perspective, particularly in the SME market, speed of implementation and updates using [the] cloud will drive down costs.”

Technology and talent management

Among the most pressing concerns for employers are workforce issues, such as talent acquisition, staff retention and employee engagement, all of which can be influenced by the employee benefits offering.

The key is to provide a benefits package that offers relevant options to employees of different generations and profiles, and to make it easily accessible. For example, while older employees may be interested in pension contributions, younger staff may see more value in benefits that help them save for their first home.

Such flexibility would be complex to administer but major efficiencies can be gained with the use of benefits software, says Jonathan Underwood, director at JLT Employee Benefits. “This can automate the entire process, from an individual’s benefit selection through to HR, payroll, benefit providers and administration systems,” he says.

Allowing employees to notify the system about their own changing life events, and allowing the system to change benefit entitlement automatically in some circumstances, can create further efficiencies.

Some might be concerned that extending flexible benefits and choice creates more admin. However, Gregson says this is not the case because most employers moving to flex tend to take the opportunity to fundamentally review benefits processes and systems. “Adding choice doesn’t equate to added admin, as single feeds in and out of good benefits platforms negate the impact,” he explains.

Greater flexibility

In terms of trends, employers are implementing technology to introduce total flexibility, beyond the once-a-year view of flex. As a result, anytime windows, benefits expense schemes and schemes where employees can request payroll reimbursements for categories of health and wellness expenses they incur personally are becoming more prevalent.

Benefits technology is particularly useful for international businesses, because data can be more readily analysed by HR managers looking to value and compare reward packages. Technology can deliver comparisons across competing organisations in a sector and deliver one-on-one benefit comparisons by employee against national statistics.

When choosing a benefits software system, employers need to think long term and look for options that will engage their staff well beyond the initial launch. Thompson adds: “They should carefully think about what they are looking to achieve and what will encourage their employees to keep visiting the site.”

Case study: Bwin.party generates cost savings with single platform

As a growing online gaming business, Bwin.party wanted to implement a global reward infrastructure that would encourage organisational agility and deliver a universal reward scheme across seven countries with different languages, employment law, tax and culture.

Bwin.party is the result of a merger between PartyGaming and Bwin Interactive Entertainment in March 2011. Working with provider Thomsons Online Benefits, it developed a single technology platform to deliver pay, benefits, share and recognition schemes. The scheme, just.rewards, was launched in the UK and Gibraltar in April 2012, before being rolled out in India, Bulgaria, Austria, Sweden and Israel.

By standardising its reward approach, global mobility has significantly improved with a 50% increase in the number of staff relocations. Employee engagement and participation in the scheme was also high, with login rates of up to 98%. Significantly, the benefits technology generated more than £300,000 in cost savings on the existing reward administration system.

Kathy Swindley, group HR director at Bwin.party, says: “As well delivering many business benefits and generating cost savings, we have seen phenomenal employee engagement with the scheme, and it has enabled us to deliver a truly global reward strategy.”