More than a quarter (28%) of chief executive officers (CEOs) in the FTSE 350 saw no base salary increase at all in 2013, according to research by consultancy EY.

Its Into the light: a look back on 2013 and insights into the new landscape of executive reward research found that, where pay increases were given, the average was 2.6%.

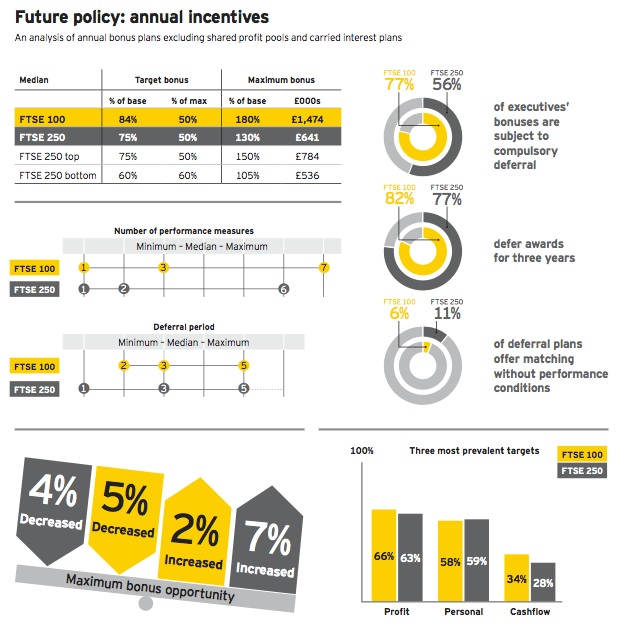

It also found that CEO bonus payments in the FTSE 100 decreased by 5.2% in 2012/13, compared to an increase of 0.3% in the FTSE 250.

More than two-thirds (40%) of the FTSE 100 awarded bonus payments subject to deferral to help foster a long-term outlook, while only a quarter of the FTSE 250 adopted this practice.

The research also found that 71% of FTSE 100 companies will require their executives to hold double the value of their base salaries in shares, compared to just 34% of FTSE 250 companies.

Similarly, the number of companies requiring post vesting holding periods, which extend the mandatory period for shares to be held in a company, will be 5% higher in the FTSE 100 than the FTSE 250.

Mark Shelton, head of executive compensation and reward at EY, said: “Last year was characterised by a marked shift in approach to executive pay and remuneration by organisations.

“Greater scrutiny from institutional investors and the introduction of new legislation in remuneration disclosures, coupled with continued economic uncertainty, has led to a climate of restraint and of rethinking the relationship between executive pay and business performance.

“While compliance with the Department for Business, Innovation and Skills’ new regulations will continue to be a focus for all UK employers in 2014, the underlying issue is demonstrating a better linkage between pay and sustained long-term performance.

“This change has provided a real opportunity for organisations to go back to their core principles and assess the financial and non-financial behaviours their remuneration packages should be driving.

“In order to truly drive sustainable business performance, an effective pay programme needs to be tailored to the organisation, rather than simply aligned with the industry norm, broad investor interests and regulatory requirements.”

Jessica Norton, a director in executive compensation at EY, added: “The FTSE 100 is leading best practice in both pay disclosure and underlying remuneration policy design.

“As a result, shareholders responded positively during the 2013 AGM voting season, with much lower levels of dissent.”