Flexible benefits technology has come a long way since it made its first tentative appearance in the employee benefits arena more than two decades ago, and it continues to evolve rapidly. New developments in technology, systems and software have transformed the way flex schemes are devised, administered and used.

Most notable are the changes that enable organisations to offer their staff much greater choice, not just in terms of which benefits to choose, but also in the way they make their choices.

Today’s flex schemes go beyond providing access from an office desktop terminal or an employee’s home computer. The age of internet browsing ‘on the go’ has resulted in increased demand for platforms to be compatible with mobile devices, as well as having applications (apps) that can be downloaded by staff.

In fact, one of the key drivers of the latest developments in flex technology is the proliferation of smartphones and tablets that enable people to manage their benefits choices on any device, any time, anywhere.

The trend towards mobile technology has seen more employers invest in developing and upgrading their platforms and systems, leading to greater competition in the industry and products that have more features than ever before. This, in turn, has made it much easier for employees to integrate benefits arrangements into their everyday lives.

Cloud-based systems

Alongside this growth in mobile flex technology is the adoption by some providers of internet or cloud-based systems, which can reduce costs, increase flexibility and allow greater scalability for employers, without compromising data security or system access.

With this new technology that makes it easier for staff to access benefits at their desk, at home or on the move has come other developments in terms of the benefits and providers. Less conventional benefits that can now be offered through flex include a concierge service, home-to-work private transport, and mobile phones. Some may be offered via a salary sacrifice arrangement, maximising tax and national insurance (NI) efficiencies, while others may offer heavily discounted corporate rates.

Another key trend to emerge is the single branded platform through which staff can access all their benefits and link through to providers’ micro-websites. This can cover, for example, a pension scheme, insurance and retail discounts, using single sign-on (SSO) technology.

One example is Lorica Employee Benefits’ iPortal, which uses password storage and benefits signposting to ensure employees need only one username and password to access all their benefits.

SSO technology also enables HR and reward professionals to access the same system at various levels remotely, to view all activity, produce management reports and target communications, streamlining the administration process.

Another feature of the technology behind modern flex systems is the ease with which it allows employers to create and administer multiple enrolment windows for specific benefits, for example mobile phones with contract renewal dates that may not coincide with the annual fl ex window.

Retail distribution review

Legislation is also driving developments and 2013 is likely to see some changes in the way flex schemes are run because of the retail distribution review (RDR). From 1 January, all independent financial advisers and employee benefits consultants must be remunerated through fees rather than commission.

Unlike commission-based arrangements, where the provider pays the adviser following the purchase of a flex package, or certain components of it, often resulting in reduced costs to the employer, the fee-based model puts the payment into the hands of the employer or employee. The RDR changes only affect benefits schemes set up after 1 January 2013.

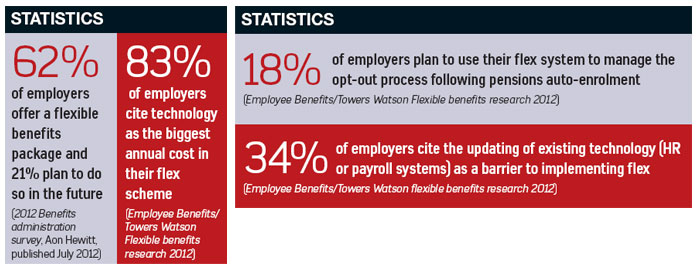

One of the biggest challenges facing many employers this year is auto-enrolment. For those that already operate a flex system, integrating it effectively with a pension scheme will help to ensure smooth implementation.

Another challenge facing employers offering flexible benefits plans is knowing how well informed their employees are about the range of benefits available. Key questions to consider include: when employees are making decisions about the more complex financial benefits on offer, are they well informed and doing so from a position of clarity, and do they fully understand the choices available and the selections that they eventually make?

As face-to-face advice on benefits and financial matters becomes ever more expensive and difficult for employers to facilitate, technology-based information and support, including interactive online modelling tools for pensions and savings, could play a part in filling the ‘education gap’ and ensuring individual members of staff have a better understanding of how to plan for their financial future and make the most appropriate choices for their personal circumstances.

Costs fall significantly

One notable development in flex benefits technology is the cost, which has fallen significantly in recent years, putting some fairly sophisticated technology-driven systems within the reach of smaller organisations. This development has been driven by increased competition in the market, which is now populated by a wide range of providers, ranging from employee benefits consultants and financial advisers to online technology services firms.

Consolidation has also been a factor, with acquisitions enabling providers to explore new areas and markets.

Some providers have also formed partnership agreements and strategic alliances to help them extend the range of products and services they offer.

In 2012, for example, HR and payroll services provider ADP announced a partnership with Thomsons Online Benefits to help organisations meet the challenges of pensions auto-enrolment.

In another move last year, the acquisition of Alexander Forbes Consultants and Actuaries by the Jardine Lloyd Thompson Group’s employee benefits business has enabled the provider to offer enhanced auto-enrolment technology and consultancy systems, strong administration capabilities and a range of wealth management services.

Some flexible benefits providers are also looking to extend their reach internationally, with the objective of using a single platform to offer a flexible benefits scheme to employees working overseas. It seems that flex technology will continue to evolve in terms of functionality, while wider legislative and industry developments could impact the market at a more profound level.

Advances in technology systems and software are enabling flexible benefits schemes to realise their true potential for employers and employees.

With real-time flexibility and systems that can be adapted according to the time of year, key stages in the reward cycle, or even employees’ personal preferences, flexible benefits technology can now offer true flexibility.

THE FACTS

What is flexible benefits technology?

It is a technology system, operating in-house or from cloud-based servers, that provides a platform to deliver a flexible benefits scheme. Increasingly, systems are designed to interface with other elements of benefits and reward, including pensions, and often feature interactive tools and data-modelling programmes that can be used by employees.

What are the legal implications?

All benefits offered within the flex scheme must comply, and be updated in line, with relevant legislation, while the system itself must comply with data protection regulations.

What are the tax issues?

HM Revenue and Customs’ (HMRC) rules around salary sacrifice arrangements will apply to any flexible benefits offered.

Where can employers get more information and advice on flexible benefits technology?

There is no industry body for flexible benefits technology, so employers are advised to speak to several providers and, if possible, other organisations that have already introduced a flexible benefits system.

What are the costs involved?

This will depend on the number of employees and the degree of sophistication required in the scheme. Providers estimate that running costs at the lower end of the spectrum range from around £5 a year per employee, while the top end ranges from around £10 to £30. A flexible benefits scheme, including systems, can be implemented for anything between £10,000 and £30,000.

Which flex technology providers have the biggest market share?

Leading providers include JLT, Staffcare, Thomsons Online Benefits and Vebnet. Others include Aon Hewitt, Benefex, BHSF, Capita, Co-operative Flexible Benefits, Edenred, Lorica Employee Benefits, Mazars Employee Benefits, Mercer, NorthgateArinso, Personal Group and Towers Watson.

Which flex technology providers have increased their share most in the past year?

There is no central organisation that provides specific market data. However, consolidation through strategic partnering and acquisitions is likely to put active providers in a position to increase market share. Staffcare, for example, which has formed strategic alliances with the likes of workplace savings firm Hargreaves Lansdown, grew its revenues by 100% in its last financial year to June 2012.

Hello

Can I see a demo?

Regards

Diarmuid

Flexible benefits tech