Need to know:

- The lifetime allowance for pension contributions will be reduced from £1.25 million to £1 million from 6 April 2016.

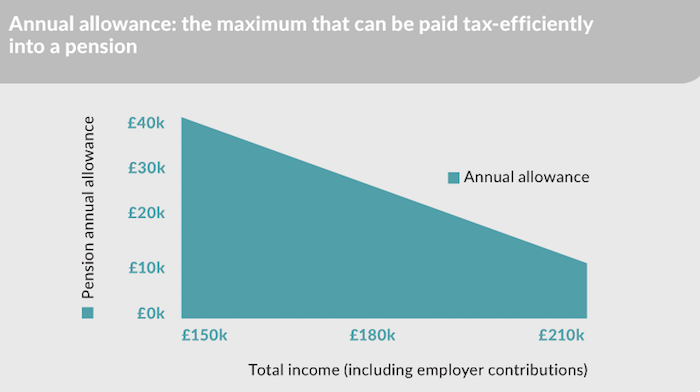

- From April 2016, those earning between £150,000 and £210,000 a year will face a tapered annual allowance for tax relief from £40,000 to £10,000.

- Communication can be used to ensure that all affected employees are aware of the changes.

In his Summer Budget 2015, Chancellor George Osborne confirmed that the lifetime allowance for pension contributions will be reduced from £1.25 million to £1 million from 6 April 2016, as previously announced in the March 2015 budget. However, Osborne also announced that the annual allowance for high earners will be reduced. From April 2016, those earning between £150,000 and £210,000 a year face a tapered annual allowance for tax relief from £40,000 to £10,000.

Changes for the year ahead

The changes to the lifetime allowance mean that the maximum amount anyone wanting to contribute tax efficiently into a pension will fall to £1 million. Overpaying this limit will incur a 55% tax charge if taken as a lump sum.

This will affect any employee with undrawn funds in a UK pension scheme where the lifetime savings exceed this value as at 6 April 2016. This limit has fallen by 44% since 2010, so this could be unwelcome news to employees that have built up a pension pot with the old limits in minds.

Although employers have no legal responsibility to offer support to staff in addressing this change, it is an accepted view that they should offer help where possible. David Pugh, managing partner at Lemonade Reward, says: “Most employers of choice will want to go a long way past just telling people what to do, and help them make appropriate decisions. There is no legal responsibility for employers to do anything, but it’s good practice.”

Sending out wide-reaching communications will ensure that all employees affected are aware of the changes. Ian Neale, director at Aries Pension and Insurance Systems, says: “Employees should be alerted to the reduction and, in particular, the process by which they can protect benefits accrued by either fixed protection or individual protection.”

If an employee wishes to retain the current lifetime allowance they must have no pension benefit accrual after the 6 April deadline. If they wish to lock in the value at 5 April and retain the ability to contribute in the future, they should apply for individual protection. “Employers would need to communicate about the different options, the fact that someone can register for fixed and individual protection as they wish,” says Neale. “It’s not an either/or situation.”

Tapered annual allowance

While employees affected by the changes to the lifetime allowance should have a reasonable idea of their accrued benefits, the introduction of the tapered annual allowance is likely to cause more complications. “Somebody who is affected by the taper may be blissfully unaware of it, because it’s really not until the end of the tax year that they know how much their benefit accrual during the year is,” explains Neale.

The taper will see higher earners, beginning with those earning £150,000 a year, limited to the amount they can save tax-free into a pension each year. This will fall from £40,000 down to £10,000 for those earning £210,000. Overpaying this limit will incur a 45% tax charge.

If an employee does receive a tax bill at the end of the tax year, they can inform the pension provider to pay it directly to the revenue from the pension fund, as long as it is more than £2,000.

The potential problem for employers is that they may be unaware which employees fall into this bracket. The total income includes not only salary, bonus payments and employer pension contributions, but also income from other sources, such as dividends or property income, which an employer may not have knowledge of. Therefore, it may be challenging to capture all affected employees in communications.

Immediate call to action

If they have not already done so, employers should start communicating now, says Jackie Holmes, senior consultant at Willis Towers Watson. “There is a need for communication to make sure [employees] are aware of that deadline and of the changes.”

With the annual allowance, it is more difficult for employers to know who will be affected, and the individual themselves may not even realise. In addition, the number of higher earners can differ greatly among organisations; some may have one or two, while others will have significantly more.

“We’re finding that support is generally taking the form of generic information and education, rather than full advice, as to what [an employee] should do, primarily because of the numbers involved and the cost of providing full advice as an employer,” says Holmes. “[Employers] may see it as a better and more equitable spend to look at a wider education programme. From a governance and a best-practice view, employers want to make sure that their members aren’t caught unawares with what could be a substantial tax charge in some cases.”

Employees’ options

As well as supporting employees with information and education about the allowances, employers can make them aware of some of the options available to them.

One option is for the employee to change their pension contribution, and perhaps stop contributing altogether. However, if the employer contribution is linked to the employee’s, it could get complicated. “The employer needs to reconsider its pension strategy for its higher earners: is it happy that the employee stops contributing when usually they would have to?” says Lemonade’s Pugh. “Will the employer allow the employee to stop contributing while it still pays in its contribution?”

Another option is to consider the employer contribution, for example, would a higher earner be better off having their pension contribution put through their salary, in effect getting a cash allowance? This brings with it a tax liability for the employee and a national insurance contribution from the employer, so it is a case of reasoning what the most effective method is.

Stewart Hastie, pensions partner at KPMG, says: “Generally we are seeing employers provide a cash allowance for high earners that opt-out of pensions saving due to the changes to the lifetime and annual allowances.”

KPMG conducted research among employers in December 2015. “Just under half [of respondents] are offering a cash allowance to affected employees, just over 20% are undecided and around a quarter are offering nothing,” says Hastie.

“Only 5% are looking at offering [an] alternative workplace savings arrangement [such as] individual savings accounts (Isas) but I expect this to grow over time, particularly if we get major reform announced at the March Budget,” he adds.

An alternative consideration is whether the money could be placed in a different investment vehicle, such as an Isa as Hastie suggests, a bank account or a venture capital trust. Pugh says: “There are other options, but there isn’t an option that gives the tax breaks that a pension does, with the simplicity, and the low cost. It doesn’t cost much for [an employer] to pay into a pension, but if it had to set up a fancy investment for a small number of people, it would probably cost them. And beyond pension, what’s right for one person, might not be right for another.”

As April approaches, the challenge for employers is to use a communication strategy that is appealing and engaging in order to support their higher earners in making the most appropriate decisions.

Viewpoint: Striking the right balance with pension communications

Viewpoint: Striking the right balance with pension communications

The new tax year sees yet another adjustment to the rules governing tax relief for registered pension schemes. As the current regime celebrates its tenth anniversary, one of its principal objectives, a simplification of the tax rules, now seems a cruel and ironic joke. There will now be no fewer than seven different forms of protection to mitigate the impact of a reduced lifetime allowance.

Implementing tapered relief for the annual allowance will present a serious challenge for scheme administrators. An additional layer of complexity will be difficult to communicate to employees, but with a growing number of individuals being caught by constraints within the tax system, it is important that the implications are fully understood by those affected.

An important point to note is that the decreases to the annual and lifetime allowances are now such that they do not affect just those who are highly paid. It has been calculated that an employee in his or her 30s with a current pension pot of £40,000, making gross contributions of £1,000 a month, is entirely likely to be caught by the annual allowance before reaching state pension age. The tapering of relief for the annual allowance means that many, especially those accruing benefits within a defined benefit (DB) scheme, will find themselves subject to a retrospectively-calculated tax demand in 2017.

Communications to employees will, therefore, have to strike a careful balance. On the one hand, effective retirement planning remains crucially important for employees and any message that appears to undermine the importance of pension saving is to be avoided. Employees must, however, have an informed long-term view of the impact of changes to the tax rules and this applies as much to those in the early stages of their careers as to those whose accrued pension savings will be in excess of the new lifetime allowance come April.

Tim Middleton is technical consultant at the Pensions Management Institute (PMI)