The successful implementation of a flexible benefits scheme in the UK is a key driver for international employers wanting to roll out their plan overseas.

If you read nothing else, read this…

- A growing number of employers are interesting in globalising their flexible benefits schemes.

- Employers should start by identifying their objective in doing so.

- Challenges include the different tax and legal systems across the globe.

The desire to streamline a flexible benefits offering is also a common motivator for a global strategy. Niall Munro, a director at employee benefits provider Fair Care, says: “It is often a change in responsibility for people looking after these [global] benefits. They have suddenly inherited them and would like to streamline them to make them easier to manage.”

But the move to go global can also be attributed to the emergence of international benefits roles, says Martha How, a reward principal at Aon Hewitt.

“There used to be professionals who had regional remits, so they perhaps had responsibility for Asia or for Europe, but now there are genuine heads of global benefits, and they have a remit to consider things like global risk management and multinational pooling of risk benefits, and to have a consistent policy and a consistent approach,” she says.

How says once a professional is given responsibility for global benefits management, for which their capability and performance will be assessed, they will make a serious move towards globalising their organisation’s flex scheme.

Global challenges

But there are many challenges in globalising a flex scheme, not least the complexities created by differing tax and legal systems across the world, particularly in Europe.

A good starting point for employers is to determine their motivation for globalising their flex scheme, and their overall objective for doing so. For example, is the aim simply to streamline existing, disparate flex offerings in multiple countries, or is there a more targeted reason, such as a desire to engage a disenfranchised workforce?

Matthew Gregson, managing consultant at Thomsons Online Benefits, says: “Identifying the business case for doing it is a real challenge and the reason is from a cost and value perspective, which will vary greatly by location.”

Employers must next consider the complexity of the benefits they are considering rolling out abroad, the employee population in each country involved, and the organisation’s preparedness for the new scheme.

“A larger population will typically warrant the business case for putting flex in, whereas with a smaller population, [employers] probably won’t get the economies of scale, or the terms required,” says Gregson. “From a readiness perspective, it’s whether or not there are systems and processes in place to support it.”

Employers must also consider the capability of their current flex provider to deliver a global scheme and, if the provider falls short of their requirements, the availability and competence of alternative providers in the countries where they want to roll out their scheme.

Country differences

The benefits selected must be relevant to each location, so employers must take into consideration the tax and legal systems in each country on their radar. For example, healthcare benefits such as private medical insurance may not be valued as much by employees in the Netherlands, where employers are required to pay at least 70% of the salary of a staff member who goes on sick leave for up two years, whereas in the US, the proportion of employers offering healthcare benefits is in decline and the cost of healthcare is high.

How believes such local differences are not insurmountable, even though employers cannot have a single plan covering various fiscal jurisdictions. “It just isn’t technically possible, because the way you tax benefits in France is different to the way you do it in the UK and the US,” she says. “But what employers can do is develop a globally consistent framework, which then can be applied locally.”

Alternatively, employers may choose to offer total reward statements, but not go as far as to offer flex. Reasons for doing so include: the extent to which flex offers employers a return on investment in terms of employee engagement, for example; the cost-efficiency of the underlying benefits; and the efficiency of benefits management in terms of the time demands on internal HR and benefits professionals to manage the scheme.

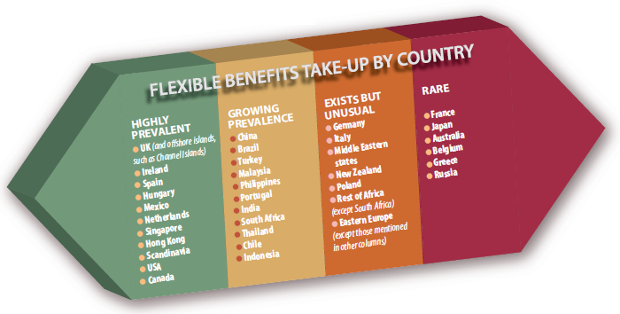

But flex is not suitable for all countries. Gregson says: “There are some markets in which flex doesn’t exist in any guise. There is a common misconception that flex exists in Europe, when it really doesn’t exist in any guise.”

Charlotte Godley, a senior associate at Mercer, adds: “Flex works best in the UK, but that doesn’t mean it doesn’t work elsewhere. I think that overall, putting flex in globally, which a number of employers are doing, is not easy and it takes a lot of work.

“It’s a bit like doing a Rubik’s Cube: you just think you’ve got one side sorted and it all looks good, then you turn it over and you realise there’s loads of other bits you’ve missed or need to get lined up.”

Communication design

Flex communication strategies can be just as challenging. “Communication strategies can be as big as the projects themselves,” says Fair Care’s Munro. “There is such a broad spectrum of how schemes can be communicated.”

Anne Oliver, head of communications at Aon Hewitt, adds: “When employers are thinking about branding, the global side can be a challenge because every country has its own idea of design. There has to be stakeholder agreement on this.”

Employers must ensure their communication campaigns do not offend anyone, for example in terms of colour, language or cultural references.

Finally, employers need to be realistic about the time it can take to implement a global flex scheme, which be several years for a large organisation rolling out a scheme to multiple countries across the world.

That perhaps explains why there are currently as many employers considering globalising their flex scheme as there are organisations actually doing so.

Flexible benefit popularity by country

Viewpoint

Terry Gostelow: The challenges involved in globalising flex

The rollout of global benefit platforms is treading a similar path to those in the payroll and human resources information system (HRIS) industries, where global providers have become established in recent years. However, while payroll in particular, and sometimes HRIS, remain a back-office tool, rolling out a benefits platform globally is likely to involve a level of employee self-service and choice.

The complexity of a global benefits platform starts in the benefit plans themselves. Some employers might think benefits do not vary, but interaction with social security, complex eligibility, intricate funding rules and the potential for large numbers of benefits across a global system can present challenges.

When constructing a rules-based system to cater for this variety, there is inevitably a balancing act of incorporating every conceivable complexity with having a system that is simple to administer and maintain.

The next challenge for employers can be presenting information to employees in a meaningful and intuitive manner, and in a language that is relevant with cultural norms that are familiar. To do this, employers require a platform developed specifically with global deployments at the heart of their design.

And although flexible benefits are commonplace in the UK as well as other specific territories, employee choice can be an unfamiliar concept in many countries, so employee interaction with a system might be limited to communicating and reinforcing the value of benefits and reward.

However, the importance of a global benefits platform is not just in employee interaction. In an age that requires the immediate availability of data, this extends to the consolidation of information in one place, being able to quickly report on costs and liabilities across a global organisation, which can then shape better and more informed decision-making.

Terry Gostelow is an account director at Staffcare

Read the full version of our Flexible Benefits supplement.

Globalising a Flexible Benefits system as opposed to a Total Reward System is far more restrictive for clients. We have been introducing global total reward systems for over ten years – it is not a new phenomenon. But introducing Flexible Benefits systems to different countries is difficult since these are largely UK focused whereas TR is international.

sildenafil citrate red eyes