Employee benefits play a critical role in helping employers expand into new countries, either through organic growth or through acquisition.

If you read nothing else, read this…

- Employee benefits can help employers recruit, retain and incentivise staff in new countries.

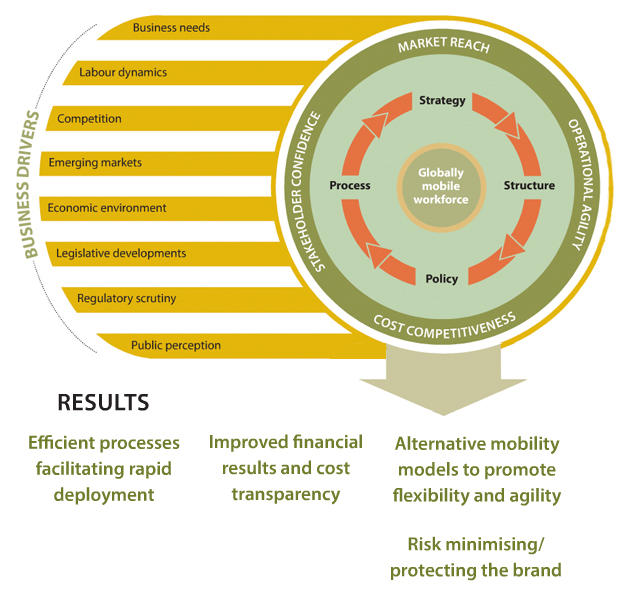

- A well-planned strategy is key to a consistent benefits offering across multiple locations.

- Deciding which benefits to offer global staff can be a challenge.

Organisations can use employee benefits to help recruit and retain staff they relocate to new territories, as well as to incentivise their performance. Employers may also need to use benefits to incentivise employees to relocate to certain countries, particularly to more remote locations and those where there is political unrest.

A well-planned benefits strategy is instrumental to any successful global expansion programme . Jeremy Hill, director of the international consulting group at Towers Watson, says: “I have just been working with an employer that has expanded into lots of markets without having a [benefits] strategy. It has ended up doing it on an ad-hoc basis, so it’s almost been a question of individual negotiations, and that creates a problem.”

Hill says a lack of strategy can result in employers operating inappropriate and inconsistent benefits across multiple locations.

Global audit

Employers should begin their expansion plans with a global audit of their benefits provision.

Karen Gamble, head of client relations at the Health Claims Bureau, says: “A global audit is critical at the outset of an expansion project, and it has to be broken down into three areas: what employers are required to provide in each country, what is reasonable and customary in each country, and then [employers must] look at the nature of the workforce, whether it is expatriate, local or third-party national.”

In terms of legal requirements, some countries will only issue work visas for expats with health insurance in place. Abu Dhabi goes further and requires expats’ health insurance to cover chronic conditions, says Teresa Rogers, business lead at Aviva UK Health.

She adds that employers should also consider the quality of local healthcare provision. “In terms of private facilities, is it a case of staff being able to get a good level of primary care, but then, if there is anything more serious wrong with them, that they’re going to have to move?” she asks.

As regards the nature of their global workforce, organisations need to decide whether to relocate existing employees to the new country into which they are expanding, employ local staff, or both. They must also decide whether local staff will be offered the same benefits as their expatriate colleagues.

Rogers says local staff are typically offered expatriate benefits packages in emerging markets such as China. “A blend of expats working with locals tends to be a really good combination because employers cut through some of the cultural challenges,” she says. “A strong local manager can be quite critical.”

Finally, employers need to decide whether to harmonise their global benefits.

Towers Watson’s Hill says: “Ideally, employers should be looking to create a harmonised structure, but for most of them, expansion programmes are business-driven, and it’s often a decision that’s not in the hands of HR staff.”

Employee communications

A communications strategy outlining the objectives of a benefits audit is essential , to allay any fears employees may have about a reduction in benefits.

Alan Hewitt, international benefits director at JLT Employee Benefits, says: “Employers should not be putting the fear of God into their staff in different countries, because quite often, when organisations go out to conduct research of employee benefits programmes, there is a hesitation to participate at local level because there is a fear that the employer will come along and start reducing benefits.”

Employers should clearly outline the intentions of an audit and what the organisation is trying to achieve. For example, an employer may be striving to provide the same level of, or perhaps more, benefits at a more competitive price by using the organisation’s global purchasing power and working with fewer advisers.

Biggest challenges

Data collection is one of the biggest challenges employers face in a global benefits audit.

Hewitt adds: “With the best will in the world, employees will provide data in various forms, such as online and paper questionnaires and email.”

The process can then take several months to complete, depending on the size of the country and the number of staff involved.

Determining an appropriate level of benefits can also be a challenge, particularly if employers do not have enough information about a country’s local benefits provision.

“Employers can end up with inappropriate benefits in some cases, and inconsistency,” says Towers Watson’s Hill. “For example, they may end up with too rich a set of benefits.”

Employers can ease the administrative headache of providing benefits for small numbers of employees working across a number of countries by using a cash-based approach that enables staff to buy their own benefits locally.

Hill adds: “This places the emphasis on the employee, but it can be a more efficient way of dealing with benefits than employers trying to set up a policy for a couple of employees.”

But a danger of this approach is that employees become preoccupied with managing their benefits, rather than helping to establish their business in the new territory, says Hill.

“Then there is a danger that employees don’t take up any benefits and employers have a reputational risk of staff being in a country and not having any [health] cover,” he adds.

Blended approach

Organisations may instead consider a blended approach, similar to a UK flexible benefits scheme , whereby employees can fund health cover above a basic level funded by their employer.

The Health Claims Bureau’s Gamble says employers should strive to develop an equal global benefits package as they expand overseas. “It’s not just about [employers] throwing £100 at each employee throughout the world, but whether they are going to make sure everybody has equal disability cover or pension arrangements ,” she says.

Whichever approach employers take, they should involve HR, benefits and reward professionals in every aspect of their global expansion strategy, alongside finance and global risk staff, right from the outset.

Hill adds: “The most most effective [organisations] in the mergers and acquisitions (M&A) space are those that have HR expertise within the due diligence and M&A function.”

Employees who understand the complexities of global mobility management, as well as managing multinational pooling contracts , are also key to any expansion programme.

But staff who understand how to assess whether the business benefits of global expansion outweight these complexities and costs, from global audits to staff relocation packages, are more important.

How alignment of global benefits leads to flexibility

Read also Global expansion drives expatriate benefits review

moUupS7tZ3 GQUodsS9U4   <a href=http://dns-www.employeebenefits.co.uk > moUupS7tZ3 GQUodsS9U4 </a>

??????????????????????????????????????????????????????????????????????????????? (????????????:???????????????????????????????????????????????????????????)

?????? ?????

??????

????? ??

????? ???????

?????? ??

prada phone ???

hermes ???

?????? 2014?? ??

?????? ??????

miumiu ??? ??

???????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

????????????????? ??

?????? ??

?????? ?? ??????

?????? ????????

?????????????? ???????

?????? ??? ??? ??

?????? ??

chrome hearts t???

???????????

??? ??? gg

http://www.ozu-cci.com/kyousai/burchls/tb100.htm

Gucci LV jp sale