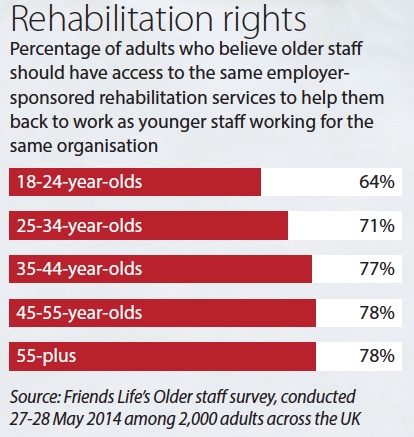

A poll conducted in May for Employee Benefits by insurer Friends Life found that 75% of adults believe older staff should have the same access to employer-provided rehabilitation services as middle-aged and younger workers in the same organisation (see box below).

If you read nothing else, read this…

- The group risk market needs to consider insuring staff that are willing and able to work past the state pension age.

- Employers should adapt their workplace for older staff and educate younger employees to mitigate the future impact of ageing.

- Group risk insurances only have to be written to state pension age, so older staff can be left out.

This highlights a huge expectation gap between what staff want and what HR departments are currently able or willing to offer.

In many workplaces, access to rehabilitation is through group income protection (Gip) products. But this type of insurance stops covering employees beyond a particular age, which leaves older staff without cover.

Many insurers will allow a Gip scheme to run to a termination age of 70 and group life assurance (GLA) to 75, but as Graham Yearsley, commercial director, employee benefits UK at Arthur J Gallagher points out, some insurers only allow GIP to 65 or the state pension age (which current age discrimination legislation says is the minimum obligation for insurers).

But Yearsley adds that some of these insurers, subject to medical underwriting and an ‘actively at work’ requirement, will continue cover to age 70.

The big stumbling block with group risk insurances is that in their current format, if they are to be underwritten to later termination ages, the cost for employers will be onerous.

“If employers change their termination dates, then it doesn’t matter if they have just five employees aged over 65, it effectively opens it up to every single employee, and therefore the cost goes up considerably,” says Yearsley.

HR align group risk insurances with staff expectations

Forward-thinking benefits managers are trying to align their group risk benefits, such as Gip and GLA, with staff expectations.

John Richie, chief executive of insurer Ellipse, says: “We have observed that there is a lot of review and a lot of policy change anticipating an ageing workforce. We see a lot of existing policies change [the age up to which they will insure staff] if staff work beyond retirement age or the retirement vesting age of the pension.”

Benefits managers cannot hide behind the cost excuse when faced with an ageing workforce. Instead, the benefits package and employer proposition as we now know them will be forced to change.

A 2013 report from Unum, 50 shades of grey: the ageing UK workforce, found that just 14% of HR managers believe their organisation is well prepared to cope with the issues around an ageing workforce.

This proportion needs to rise quickly, because employees aged over 50 already make up 27% of the UK workforce and by 2020 this will rise to one-third, according to the Department for Work and Pensions’ report Employing older workers , published in February 2013.

More staff over age 65 will continue to work

This will have a fundamental impact on both workplace health and group risk insurances. Chris Minett, managing director of AgeingWorks, says: “People will be living longer, but they won’t be living healthier.”

This will be compounded by a UK health and social care system under stress because of increasing demand. “You have these agendas described as personalisation or improving choice for users, but in fact it is the government moving responsibility on to families to be more proactively responsible for care and for their own health,” says Minett.

“We are going to have a 60% increase in the number of people over 65 by 2030 and they are the heaviest users of health and social care in a system that is already struggling.”

Employers may feel this is not their responsibility. Ellipse’s Richie says: “If somebody is working beyond 60 and 65, they are really deferring their retirement. They can access their accumulated savings in their pension pot, so should [employers] be insuring their incapacity to work or should [employees] start drawing down their pension?”

Richie also questions whether insuring for an ageing workforce is necessary for all employers. “They have to think about their own workforce,” he says. “Have they got an ageing workforce? Do they anticipate it? Are they persuading themselves that they would be totally relaxed at having a group of 60-somethings rather than a group of 20-somethings [working for them]?”

However, employers are becoming less age discriminatory, says Richie. “They value having staff with knowledge and experience, who know how to talk to people and how to engage people on the phone,” he adds.

Court case means reasonable adjustments are needed

Last October, the UK Employment Appeal Tribunal (EAT) threw a curve ball that should also give employers with an ageing workforce a push to review their physical workplace, employee benefits and occupational practices to avoid falling foul of the law.

In Croft Vets and Ors versus Butcher , the EAT ruled that the employer, Croft Vets, had not made reasonable adjustments when it failed to pay for an employee to have private psychiatric services and counselling. The ruling stated that the issue was not the payment of private medical insurance in general, but rather payment for a specific form of support to enable the claimant to work and cope with the difficulties the employee had been experiencing at work.

David Williams, director of group protection at Friends Life, believes this has potential implications for employers as regards any need to provide reasonable adjustments to the workplace, including for an ageing workforce.

One employer that is famous for adapting its workplace to accommodate older workers is BMW. Arthur J Gallagher’s Yearsley says: “In 2007, BMW did a pilot scheme to compare a group of older employees against run-of-the-mill employees.

“The study found that the quality of the work and the output among the over-50s was better than the under-50s.”

Skills shortages mean employers must keep older workers

A key catalyst for such thinking was the skills shortage in the car industry, a problem not just restricted to car makers. It is predicted that UK employers will need to fill about 13.5 million job vacancies by 2022, but only seven million young people will leave school or college over this period, according to a 2012 report from the Chartered Institute of Personnel and Development, Managing a healthy ageing workforce: a national business impertive.

“So the car manufacturers recognise there is a need to do something for the ageing population,” says Yearsley. “What BMW, and now other manufacturers, recognised is that you need to make changes in the workplace.”

For example, BMW had an on-site physiotherapist, tilted computer screens so that staff could see them more easily, and enlarged the screen text.

Those in the insurance industry know from their own claims data that, typically, staff in their 50s will be working with some form of chronic health condition. Steve Bridger, head of group risk at Aviva UK and Ireland Life, says: “It won’t necessarily affect their ability to work, but will need some form of adjustments to accommodate it in the workplace.

“What they are starting to show is the impact on the body of doing the same tasks, the same hours. The same type of physical or sedentary role can manifest differently as employees get older.”

Early prevention is better than intervention

Group risk insurances can help with rehabilitation and early intervention, but there is a step to be taken well before that. Employers need to look beyond Gip and provide workplace activities at an earlier stage in employees’ working lives that will keep them fit and healthy.

Aviva’s Bridger gives the examples of employers with staff in manual roles that offer physiotherapy in the workplace, while others encourage stretching sessions for sedentary staff. “[Employers should try to] keep the workforce active, build breaks into the day, have chairs that are more supportive, have assisted standing, wooden floors rather than metal floors,” he says.

It is not only the workplace that needs to adapt; group risk insurances also need fresh thinking to be age-ready.

Group risk insurers need to design different products

Yearsley says insurers should look at a different model for providing income to employees who are post-state pension age. “For those staff who really want to work, they should have [access to] a really proactive and robust early intervention programme or a good wellness programme,” he says.

Bridger suggests employers should look at limited-term Gip payments and flexible benefits. He points out that staff in their 60s and 70s are likely to have lower financial responsibilities than current average employees, who may have a mortage and dependants.

“Employers should consider putting in place a decent benefit that gives every member of staff the same access to a core level of support, rehabilitation and return-to-work services, as well as their own ability to choose to top up,” he says. “That can be to go from a limited-term payment through to state pension age, or to top up the percentage because they feel their financial needs would be greater if they were off sick. Then there is choice through the workplace.”

The other group risk benefit to consider is group critical illness (GCI). Staff with a family history or predisposition to, say, heart disease or cancer, have a high probability of suffering from one of these. If they were too ill to work, then a financial payment that can pay off a mortgage, give some financial stability or top up workplace savings could be the answer.

“Some form of protection in terms of financial wellbeing, such as GCI, can be very good,” says Bridger. “It can provide the money to support reasonable adjustment.”

With all these options, communication to staff is key, but it should be worth the effort because, as Richie says: “An ageing workforce will value this type of insurance more.”