Need to know:

- Insurance premium tax (IPT) increased from 6% to 9.5% from 1 November 2015, although there is a transitionary period until the end of February 2016.

- This will affect private medical insurance (PMI) premiums in particular, but there will also be a knock-on effect on national insurance (NI) contributions and benefit-in-kind tax.

- There are ways to mitigate or reduce this increase, including reviewing the existing policy carefully and looking to move to non-IPT levied products.

In his Summer Budget, chancellor George Osborne ushered in a 9.5% rate of insurance premium tax (IPT) from 1 November with these words: “With these measures, I am putting in place an approach for taxing banks and insurers over this parliament which is sustainable, stable and fair.”

Whatever the political merits of this, one thing becoming increasingly clear for employee benefits professionals is that by hiking IPT from 6% to 9.5%, Osborne has created a health insurance and benefits environment that could be said to be anything but “stable”. As Nick Jeal, head of corporate marketing at Axa PPP healthcare, points out: “This IPT rise is not just about medical insurance premiums. The government was more thinking about it in the context of big-ticket insurance items such as car or home insurance. IPT of 6% was lower than others within the EU so, in a sense, medical insurance has just been caught up in a bigger piece.

“However, given that in Germany, for example, the tax rate is 19%, it is worth being aware this may not be the last rise in IPT,” he adds.

Cost mitigation

So, what are the effects going to be, and what can employee benefits professionals do to mitigate any extra costs that result from these?

The bottom line, that IPT went up from 1 November, is straightforward enough. It will not only impact private medical insurance (PMI) premiums, but health cash plans and dental insurance will also be affected. However, with the government also putting in place a transitionary period until 29 February 2016, how and when insurers are pricing in this change appears to be anything but consistent.

In the main, most providers are increasing premiums on new business or upon a policy renewal from 1 November. With some, however, the IPT increase on changes or premiums invoiced after 1 November is being absorbed and written off until 1 March and then implemented. Others are holding the 6% rate until next renewal date and some are absorbing it for even longer, says Carol Porter, commercial manager for The Health Insurance Group. “I know of one health cash plan provider that has said it is going to absorb the increase until the end of 2016,” she adds.

“It is not ideal and quite a confusing picture,” says Nick Clayton, consultant at Towers Watson. “At the moment it is a bit of a mixed market out there in terms of who is doing what when.”

The key is to be proactive, says Porter. Employers can talk to their insurer or an intermediary that may be able to help them through the maze. An intermediary will be able to look at cost-containment items that perhaps employers have not thought of.

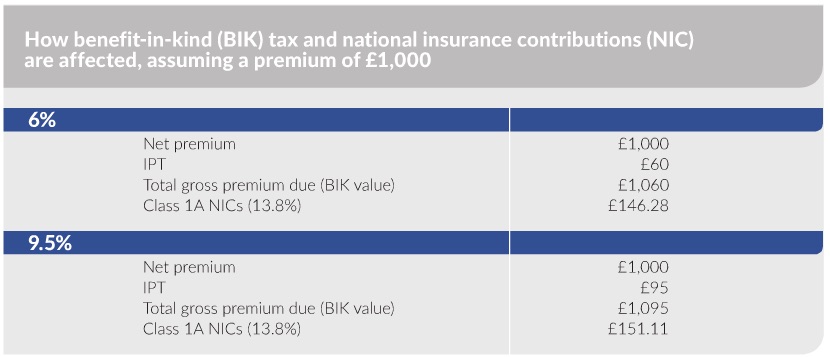

It is worth being aware that this change will not affect things such as health screening, life insurance, employee assistance programmes (EAPs), group income protection (GIP) or critical illness insurance, because these do not attract IPT. However, where IPT is levied, employers pay national insurance (NI) on the benefit-in-kind (BIK) value of the premium, so there will be a knock-on effect in these two areas (see example in table). More widely, with medical inflation estimated by Mercer in its Medical trends around the world report, published in October 2015, to be running globally at around 10% this year, this IPT rise is just one health insurance headache facing employers.

Benefits restructure

So, what can employers do about it? “It might be things such as re-cutting or restricting the benefits slightly, or looking at the level of excess or at whether [the employer] really wants or needs a particular benefits structure. It is also about providers working with employers to help them to understand the wider tax implications of this rise,” says Soraya Chamberlain, head of healthcare and wellbeing consulting at Punter Southall Health and Protection.

Another option is for employers to look at whether it makes sense to weight or adjust what they offer to products that do not attract IPT, like those listed above.

Healthcare trusts

A more radical solution is for an employer to change the format of its PMI provision, such as moving to a healthcare trust or master trust, or a corporate deductible or corporate excess scheme.

Healthcare trusts are not insurance contracts and so will not be affected by the rise in IPT, other than on a small element of stop-loss insurance. This means they may become a more attractive option in the future, says Jeal. “But understanding and setting one up can be daunting,” he adds. “The employer has to set up a separate legal entity with a board of trustees and so on. An alternative option, therefore, is a master trust, essentially a turnkey or umbrella trust offered by the provider.”

In a corporate excess scheme, a corporate excess is set up as a percentage of the notional claims fund and is held in trust by the provider, with the rest becoming a claims reserve. Claims payments are taken from the excess. If this is used in full, any further payments are taken from the reserve. The main advantage from the IPT perspective is that employers only pay IPT on the claims reserve, administration and insurance risk charges, not the excess amount.

A corporate deductible scheme is similar. It allows an employer to take out (deduct) a large corporate excess, with IPT only paid on the remaining premium. Rachel Riley, commercial director of the global brands division of WPA, says: “There are going to be many more [employers] interested in these sorts of arrangements, so I think we will see more spending more time understanding how these schemes work. It is just about digging more deeply into the options,” she adds.

So, will this mean the demise of PMI? Punter Southall’s Chamberlain argues not, but predicts the industry is in the middle of potential significant change, especially if and when further IPT rises happen.

Viewpoint: Employers need to mitigate the impact of the insurance premium tax rise

Viewpoint: Employers need to mitigate the impact of the insurance premium tax rise

The Budget’s ‘unrealistic and unacceptable’ increase in insurance premium tax (IPT) could represent the final straw for some employers that may now cancel their cover.

While I think many of us expected there to be an increase in the Budget, we are both surprised and disappointed at the size and scale of such an increase, which appears to have been announced without due consideration of the wider impact. The chancellor and his department have shown a distinct lack of consideration about the wider impact of the ‘ill-conceived’ decision.

At a time when the NHS and NHS budgets are under extreme pressure, the increase in IPT, which is estimated will raise £177m in tax revenue, will prove to be an expensive folly. The net impact will be to drive patients to an already stretched NHS adding further pressure both in terms of resource and cost.

Cost is one of the single biggest considerations for both employers and consumers as to whether they continue with their private medical insurance (PMI) cover.

[Employer] purchasers of PMI should consult with an independent intermediary that will be able to advise them of the steps they may take to mitigate the impact of the IPT increase.

There are three steps buyers of PMI should immediately consider. The first is to consider introducing or increasing a policy excess. A £100 excess applied to all plan members would typically reduce premiums by between 8-10%. Discounts vary from provider to provider based on individual circumstances. Second, employer schemes with more than 100 staff covered should consider a non-insured/self-funded option under a health care trust that does not attract IPT. And finally, consider a corporate deductible product that will offset part of the IPT increase.

Stuart Scullion is chairman of the Association of Medical Insurers and Intermediaries (AMII)