The company car has always been a popular employee benefit, even as the government nudges employers and staff towards more fuel-efficient and greener cars. However, employers must be aware of the tax liability the benefit carries with it.

If you read nothing else read, this…

- Employers must take into account all the tax and other legislation that applies to company car schemes.

- Employees are liable to pay tax according to the carbon dioxide (CO2) emissions of the company car they use..

- Lower-emission cars fall into a lower tax bracket.

According to figures from the Society of Motor Manufacturers and Traders, the number of fleet car registrations has risen in recent years. In 2012, fleet registrations totalled 958,517, up from 951,965 in 2011, and the upward trend is continuing this year.

Company car schemes are liable to benefit-in-kind tax, which reflects the staff benefit of having access to a car for private use. Mark Morton, a director of human capital at Ernst and Young, says: “Company car tax works on the basic principle that if an employer provides [staff] with a company car, they are given a company car charge. It doesn’t matter if it is used or not, it is taxed because it is available to the employee. Even if that car is sitting on an employee’s drive, the benefit charge continues.

“Cars are a hugely emotive subject and employees will change jobs just because the competitor down the road offers a nicer car.”

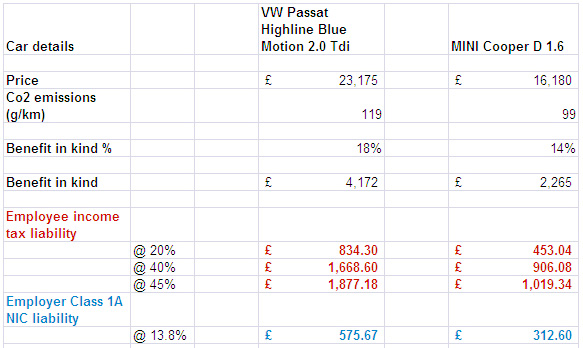

The value of a car is calculated as the new price published by the manufacturer, plus VAT, delivery, number plates and any optional extras. The driver is then liable to pay tax on a percentage of the P11D value decided by the car’s carbon dioxide (CO2) emissions.

The tax bracket is determined by the car’s fuel efficiency. Cars with higher CO2 emissions incur a higher percentage of tax.

Emissions levels

Alastair Kendrick, a director at MHA MacInyre Hudson, says: “A taxable benefit is determined by its reference to the list price of the car and its CO2 emissions. There is also a 3% surcharge with regard to diesel cars. Class 1A national insurance is payable on the benefit in kind. The restriction only applies to cars leased after 1 April 2013 with CO2 emissions above 130g/km; before April 2013, the restriction was in regard to any car above 160g/km.”

With green issues high on the government’s agenda, the tax levied on company cars is aimed at reducing emissions to help the UK meet its environmental targets. Morton adds: “The switch to emissions-based taxation was to play to the green agenda. The manufacturers have lowered cars’ CO2 emissions.”

Employers and employees must both be aware of all the tax and other legislation that covers company cars. For instance, if any free or subsidised fuel is provided for employees’ private use, they will be taxed for this benefit.

There are strategies employers and staff can use to reduce the cost of company cars. Dan Rees, a senior manager in Deloitte’s car consulting section, says: “From an employee’s perspective, it makes sense to choose a lower-emitting car if they can, because the tax bill is lower for them personally.

“From an employer’s perspective, it makes sense to provide lower-emitting cars for numerous reasons. For instance, greener cars use less fuel. So fuel costs, which are a big part of fleet costs, are lower when employers provide more fuel-efficient cars.

“Also, the higher the emissions of a car, the more national insurance will be payable.”

Another strategy is for an employee to contribute up to £5,000 to the cost of buying the car, reducing its taxable value. But the employee would have to keep and use the car for several years before they saw any real savings. Tax liability also depends on factors such as the car’s size and age, as well as the employee’s income tax rate. This strategy could be helpful to senior managers, partners or owners of a business that want to keep an expensive car or reduce a fleet’s tax liabilities.

Electric cars

Kendrick says there is a special tax exemption for low-emission (below 95g/km) cars, including electric cars. “But you wouldn’t see those in a corporate car park,” he adds. “If an employer has a sales representative travelling often, an electric car would not be fit for purpose. So there are concessions, but they don’t affect many organisations.”

Morton adds: “There is still a big question mark over how sustainable green cars are, with their battery technology and their range.”

There are also tax exemptions for pool cars, says Morton. “But they have to be available to more than one employee,” he explains. “It can’t be a company car by another means. HM Revenue and Customs polices that very closely. They would expect to see a lot of information, such as who drives the car, how many miles, and where it went.”

Viewpoint: Damian James

The lower a car’s CO2 emissions figure, the lower the benefit-in-kind tax bill is for employees. That is the mantra that all organisations running company car fleets should have been following for 10 years, since the advent of CO2-based company car benefit-in-kind tax in 2002.

The coalition government has continued the policy of tightening benefit-in-kind tax thresholds year on year and has already announced rates to the end of 2016/17. In 2013/14, the 10% company car tax rate applies to cars with emissions of 76-94g/km, but that will rise to 11% in 2014/15, with corresponding increases in other thresholds up to 35% (CO2 emissions of 215g/km and above in 2013/14 and 210g/km and above in 2014/15).

To enable long-term fleet planning, the government has promised rates will be announced three years in advance. As a result, rates for 2017/18 will be announced in the 2014 Budget. A number of key tax changes have been announced, so fleets should plan for them. These include a partial U-turn thanks to ACFO lobbying on tax rates on ultra-low-emission models.

In the 2012 Budget, the Chancellor announced rates on electric company cars would leap from 0% currently to 13% in 2015/16. This year, he announced a series of changes (see box page 44) at the lower end of the company car benefit-in-kind tax scale, including a 5% rate on 0-50g/km cars in 2015/16 and cars with emissions of 51-75g/km facing a 9% charge. Cars with emissions of 1-75g/km are now taxed at 5% and those with zero emissions at 0%.

Another key change will be a review of company car tax incentives for ultra-lowemission cars in the light of market developments in the 2016 Budget. So, fleet decision-makers must compile the most cost-effective car choice lists from the plethora of low-emission models now available and drivers must make their decisions, while bearing in mind that cars must be fit for purpose.

Damian James is deputy chairman, Association of car fleet operators (ACFO)

I’m an employee with a leased company car. I’ve been told that if my employers put any form of advertising on the car then the tax I pay is reduced. Please can you tell me if this is true?

Thanks

????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

?????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

http://www.brevik.nu/images/solica/case=weirr=v5.html iphone5 ??? ???

http://www.brevik.nu/images/solica/case=weirr=v41.html iphone5 ?????

http://www.brevik.nu/images/solica/case=weirr=v32.html iphone4s ??

??????????????????????????????????????????P????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????,?????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

????????????????????????,?????????????????????????k????????????????????????????????????????????????????????????????????????????????????????????????????·??????????????

http://www.brevik.nu/images/solica/case=weirr=v4.html iphone5 ??? ????

http://www.brevik.nu/images/solica/case=weirr=v10.html iphone 5 ??

http://www.brevik.nu/images/solica/case=weirr=v45.html iphone4s ???????

???????????????????????????????????

??????????????????????????????????????????????????????????????????????????

?????8????????????????????????????????

????????????????????????????????DFFBI??????????????????????????????????

http://www.brevik.nu/images/solica/case=weirr=v49.html iphone5 ???????

http://www.brevik.nu/images/solica/case=weirr=v0.html iphone??????????

http://www.brevik.nu/images/solica/case=weirr=v45.html fendi iphone???

????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????g?????

????????????????????????????????????????????????????????????????????????????????????????????????????????????PR??????????????????????

http://www.brevik.nu/images/solica/case=weirr=v18.html iphone4 ??? ???????

http://www.brevik.nu/images/solica/case=weirr=v49.html iphone5 ?? pc

http://www.brevik.nu/images/solica/case=weirr=v43.html iphone5 ??? ???? ??

?????????????????????????????????????????????????????????????????????????????????????????????????(?)??????????????????????????????????????????????????????????????????????????????????????????????????????????????????,??????????????????????????????????????????????????????????????????????????????????????????????????????????PKO???C????

????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

http://www.brevik.nu/images/solica/case=weirr=v3.html iphone5 ?????? ???

http://www.brevik.nu/images/solica/case=weirr=v1.html iphone ????

http://www.brevik.nu/images/solica/case=weirr=v2.html iphone5 ??

k?????????????????????????????????????????????????????????????????????????????????O???????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

?????????????????????????????????????????

???????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

??????????????????????????????????????

???????????????????????????????????????????????????????

http://www.brevik.nu/images/solica/case=weirr=v1.html iphone??? ???????

http://www.brevik.nu/images/solica/case=weirr=v10.html ??? iphone5 ???

http://www.brevik.nu/images/solica/case=weirr=v6.html iphone4 ??? ???

????????????????????????????????????????????

??????????????????????????????????????

??????????????????????????PHS??????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????EU???????????????????????????????????????????????????

http://www.brevik.nu/images/solica/case=weirr=v25.html iphone ??? ??

http://www.brevik.nu/images/solica/case=weirr=v41.html iphone4 ??? ????

http://www.brevik.nu/images/solica/case=weirr=v18.html iphone4s ??????

?????????????????????????????????,????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????,???,????????????????????????????????????????????????????????????

????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b16.html ?????? ?? ??

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b46.html ?????? ???????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b5.html ??? ?????? ??

???????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

???????????????????????????????

???????????????????????????????????????????????????????????

?????????????????????????????????????????????????????????????????????????????????????????????????????,??????????????????????????????????????????????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b49.html ?????? ???????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b36.html ?????? ??????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b8.html ?????? ??????

??U??????????????????????????????????????????????

???????????????????????????

?????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

???????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????(?????????????????????????????????????????????????????????????????????????????

??????????????????????????????????????????????????????????????????????????????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b34.html ???? ??????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b4.html ?????? ??? ???

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b16.html chrome hearts japan

???????????????????????????????????????????????????USB????

????????????????????????????????

??????????????????????????????????????????????????

????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????,??,???????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b3.html ?????? ???

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b42.html ?????? ?????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b14.html ?????? ????? ??

??????????????????????????????????????????????????????????

?????????????????????????????????????????????????

???????????????????????????????????????????????????????????????????????????????????????????????????????J???????????

?????????????????????????????????3??????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b47.html ?????? ????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b1.html ?????? ??? ???

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b11.html chrome hearts ??

????????????????????????????????????????????????????????????????????????????????????????????????????????????????

?????????????????????????????????????????????????????????????????????????#??????????3????????????????????????????????????????????????????????????????

?????????????????????????DL?????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

??????????????????????????????????????2?????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b36.html ?????? ????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b30.html ?????? ??????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b4.html ?????? ????

??????????PET??????????????????????????????????????????????????????

??????????????????????????????????????

???????????????????????????????????????????????????????????????

??????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

??????????????????????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b10.html chrome hearts used

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b37.html ???? ??????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b48.html ?????? ??????

????????????????????????????????????????????????????????????????????????=????????????????????????????????????????????????????????????????

?????????????????????????????????????????????????????????????????????????????????

?????????????????????????????

???????????????????????????????????????????????????????

?????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b41.html ?????? ????????

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b35.html ?????? ???

http://www.vett.se/wp-admin/maint/hearts=miqasdf-b4.html ?????? ????

I have a company car and if the company were to put some form of advertising on the car would my company car tax be lowered.