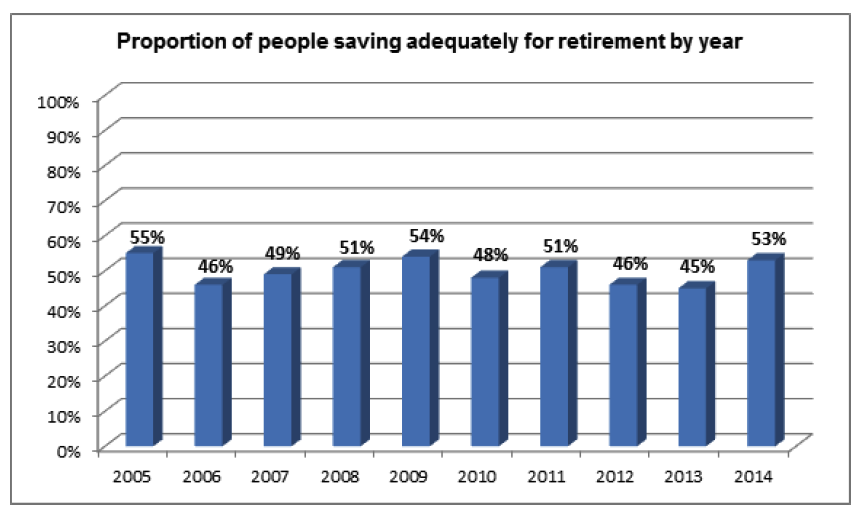

The number of people saving adequately for retirement is at its highest level since 2009, according to research by Scottish Widows.

Its 10th annual Scottish Widows Retirement report, which surveyed more than 5,000 people, found that 53% of respondents are saving enough through a pension scheme, up from 45% in 2013, as the impact of auto-enrolment and improvements in the economy take effect.

The research also found that the monthly amount the average employee is willing to contribute towards their retirement savings has also increased by 141%, from £54 in 2006 to £130 in 2014.

However, a third of respondents still have no idea of the extent to which their pension, savings and investments will meet their retirement income needs.

The research also found:

- The average proportion of annual earnings put aside by employees in organisations with 250 staff or more has increased from 9.7% to 11.6%.

- 37% of respondents feel more optimistic about their long-term finances, compared to 32% in 2013.

- 32% of respondents do not believe they will be better prepared for their retirement than their parents were.

Ian Naismith (pictured), pensions expert at Scottish Widows, said: “A decade of tracking retirement savings trends has shown us the impact that events such as the recession, auto-enrolment and the recent Budget announcements have had on the nation’s savings behaviour.

“It is heartening to see that finally people are starting to sit up and take notice of the importance of planning for the future, whether this be through proactively upping their contributions due to a more favourable economic climate, or starting to make plans for their retirement for the first time thanks to auto-enrolment.

“Although we have undoubtedly made some significant strides forward since our research first began, there are still some groups which are not preparing adequately for a comfortable later life and are at risk of slipping through the net.

“While celebrating the success of the wider savings picture, we must not forget to identify and support these at-risk groups, such as the self-employed or part-time workers, to make sure they too have a plan for securing their financial future and do not get left behind.”

In some ways this is irrelevant. We know that we don’t save enough, and especially into pensions. For those that have, however, seek advice so that you can understand what you have saved so far and realistically what sort of income that could create. There is only one message – pensions have become the most tax-efficient savings and cash vehicle there is and while you can maximise contributions.

The retirement report shows that the UK’s retirement preparedness is improving, with the Scottish Widows’ index up 45% since 2013 and at its highest level since 2009.

The single biggest determinant of your retirement income is how much you pay in to start with; the level of contributions will outweigh any other factor. The combination of auto-enrolment and the improving economic outlook means more people are saving more money than at any time since the financial crisis took hold. We also know that the new pension freedoms announced in the Budget have rekindled investors’ interest in pension saving.

There are still some significant gaps though. The self-employed are excluded from auto-enrolment and due to the eligibility criteria, so far more people have missed out on auto-enrolment (3.9 million employees) than have been brought into workplace savings (3.3 million).

With auto-enrolment looking like a success, we now need to promote the benefits of retirement saving to those still excluded and to encourage higher savings rates from those who are now planning ahead for retirement.

It is better to be saving something than nothing at all. However, for all but the youngest auto-enrolment scheme members, the default contribution rate of 8% is likely to be inadequate. Scottish Widows recommend a 12% contribution rate, which is a good average, but for some investors, particularly those only starting to save later in life, contributions may need to be higher. The best answer is to use an online calculator to work out how much you should be saving.

It seems that after many years of stagnation we may just have turned a corner and the message seems to be getting though that there is a need to take retirement planning and saving seriously.

There are obviously a number of contributory factors at play here – the upturn in the economy, greater feelings of job security and, of course, the impact of auto-enrolment. People are also becoming increasingly aware that their life expectancies are increasing and that achieving a reasonably comfortable lifestyle in retirement has to be both paid for and planned many years in advance. There is also an acceptance that working longer beyond ‘normal retirement age’ will be necessary for many more in the years ahead.

The only blot on the horizon in what is otherwise a most encouraging report is the suggestion that in many instances there appears to be a misalignment between expectation and reality and that perhaps as many as 60% of the population do not know what they need to save to secure their desired level of income in retirement. This points to the need for more guidance and advice to be provided to consumers both in the workplace and elsewhere with a view to ensuring that they get the best returns from their pension saving in all circumstances.

It will also be necessary sooner rather than later to consider increasing the minimum contribution levels specified for auto-enrolment to secure better outcomes for contributors and ensure the early success of the policy is maintained.