The facts

What is group income protection (GIP)?

GIP pays a regular monthly benefit if an employee is unable to work because of long-term illness or injury. Benefits are payable until the employee returns to work or, if earlier, state pension age. Fixed-benefit term policies are also available, typically for periods of two to five years.

As well as financial support, GIP gives employers and employees access to rehabilitation. This can include advice on adapting an employee’s role to suit their illness or injury.

What are the origins of group income protection?

The first modern GIP policies were written in the 1950s, but a broader form of cover, the Holloway scheme, was available from the late 19th century, offering retirement benefits as well as income replacement.

Where can employers get more information and advice?

Industry body Group Risk Development (Grid) promotes group protection products. Its website has information about group income protection and contact details for intermediaries and insurers in the market.

What are the costs involved?

Full cover costs between 1% and 1.5% of gross payroll, but a limited-term policy can reduce the cost to 0.25%.

What are the legal implications?

GIP has an exemption from default retirement age legislation, which means employers can stop providing it when employees reach the state pension age.

What are the tax issues?

Employers can usually get corporation tax relief on premiums and it is not considered a P11D benefit.

What is the annual spend?

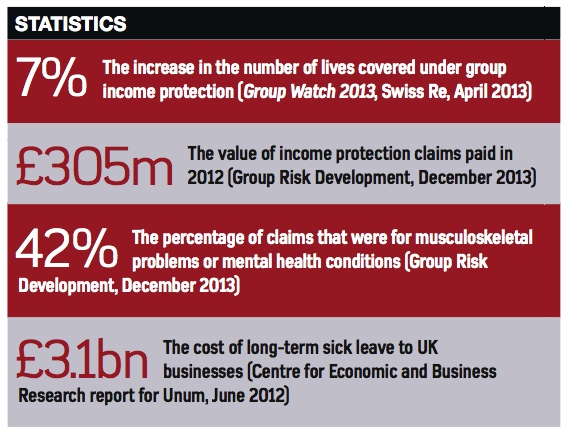

According to Swiss Re’s Group Watch 2013 report, published in April 2013, in-force GIP premiums totalled £563 million in 2012.

Which providers have the biggest market share?

No market data is available, but the largest provider is Unum, which accounts for about 50% of the market. Canada Life is in second place, and other players include Aviva, Ellipse, Friends Life, Legal and General, Personal Group and Zurich.

Which providers have increased their market share the most?

Again, no market data is available.

As well as being a valued employee benefit, GIP supports employers by covering any contractual promise of long-term sick pay to employees.

Standard policies pay between 75% and 80% of annual salary following a set waiting period, known as the deferred period. This is typically 26 weeks after the employee first goes off sick.

Benefits are paid to the employer, which deducts tax and national insurance before paying the employee. The amount that is paid can be fixed or can rise in line with inflation or a set percentage. The policy will keep paying out until the employee reaches state pension age, currently 65, or earlier if the employee returns to work or if it is a limited-term policy.

The cost of cover depends on various factors, including the age profile of employees, occupation and claims history. Policy features will also affect the premium. For example, to reduce the cost of cover, an employer could select a longer deferred period, a lower level of benefit and a limited payment term.

Rehabilitation support

While GIP provides a highly desirable financial benefit for an employee who is unable to work because of illness or injury, a plan’s additional features can be even more valuable.

Most insurers include a rehabilitation service, which can help employers to manage sickness absence and provide the advice and medical intervention to facilitate an employee’s return to work.

For example, as soon as an insurer is notified that an employee is off work and could become a claim, it will case-manage the absence and put together a rehabilitation plan for the employee. This could include a return to work on a part-time basis, or to a lower-paid position. Where this happens, the insurer will pay a partial benefit, so the employee is not out of pocket.

The nature of the most common causes of claims makes this type of support particularly useful. According to research published by Group Risk Development (Grid) in December 2013, the two largest causes of claims in 2012 were mental illness and musculoskeletal conditions, each accounting for 21% of claims. These are areas where early intervention and targeted treatment can significantly improve an employee’s chances of recovery.

Early intervention

To give their rehabilitation services the best possible chance of success, some insurers offer an incentive for early notification. For example, Legal & General offers a bonus of 5% of the annual premium to employers with schemes covering at least 250 staff if they notify the insurer of at least 80% of absences within a set timeframe.

Similarly, Ellipse gives a 10% premium discount to employers that report all absences before the end of the fifth week of absence or if there have been no employees absent for more than four consecutive weeks in a year.

Insurers have also added a variety of benefits to keep GIP attractive even when there are no active claims. The most common of these is an employee assistance programme (EAP), which provides telephone-based support and information on topics ranging from stress and mental health problems to debt and parenting advice. EAPs can also support line managers by providing assistance with work-related issues.

And although EAPs may be relatively common across the GIP market, many insurers are looking to add features to differentiate their products. For example, Ellipse offers an absence management service to make employers aware of potential claims, and Legal and General introduced an interactive online stress toolkit in 2013 to help line managers identify and support staff suffering from stress and mental health problems.

Call for compulsion

Almost two million employees had GIP cover in 2012, according to Swiss Re’s Group Watch 2013 report, published in April 2013, but sales are expected to have risen further because of pensions auto-enrolment. As employees are opted into their employer’s pension scheme, the link between workplace pensions and GIP schemes has meant that many staff have automatically received GIP cover, too.

In fact, there are now calls to make GIP a compulsory benefit. Supporters of this move argue that having insured benefits in place would significantly reduce the welfare burden on the state.

There are already indications that employers back this step, especially if they were offered a tax incentive. For example, in its Group Risk Employer Research, Grid found that 52% of employers surveyed would support an initiative to auto-enrol employees into group risk protection products alongside pensions. In addition, 62% of respondents would be encouraged to offer their employees protection if the government introduced some form of incentive to do so.

But, with auto-enrolment continuing to roll out over the next few years, such a move is unlikely to happen soon. In the meantime, insurers are seeking to attract employers with more affordable options.

Top of these is the limited-term policy, which can cut the cost of cover by up to two-thirds. Rather than provide cover until state pension age, these plans pay out for two to five years, after which a lump sum of up to five-times salary can be made. This lump sum could be used to pay redundancy or fund early retirement.

Also, some insurers are looking at ways to spread the cost between employer and employee. For instance, the flexible funding arrangements on Unum’s Select plan enable an employer to pay a fixed amount for each employee, make a partial contribution of up to 75% of the total contributions on behalf of the employee, or allow employees to fund 100% of their contribution.

As state benefits continue to reduce, insurers are likely to explore other lower-cost options to enable more employers to take out GIP.

This is the perfect website for everyone who really wants to find out about this topic. You know a whole lot its almost tough to argue with you (not that I really would want to…HaHa). You definitely put a fresh spin on a topic that’s been discussed for ages. Great stuff, just wonderful!