Need to know:

- Businesses should analyse the cost implications for payroll and earnings-linked benefits.

- Salary sacrifice arrangements could result in non-compliance by bringing pay below the new £7.20 hourly rate.

- Investing in the workforce through employee benefits can drive productivity and thereby help mitigate higher wage costs over the long term.

In his 2015 Summer Budget address, Chancellor George Osborne declared: “Britain deserves a pay rise and Britain is getting a pay rise.” This pay rise will officially arrive in the form of the national living wage from April 2016, at which point it will become mandatory to pay staff aged 25 and over at least £7.20 an hour.

The national minimum wage will continue to apply for younger staff, currently set at £6.70 for those 21 and over, £5.30 for 18-20 year olds, £3.87 for under 18s, and £3.30 for apprentices aged 16-18 or those aged 19 and over who are in the first year of their apprenticeships.

Somewhat confusingly, or some might say shrewdly, the Chancellor has given the new compulsory rate a name not wholly dissimilar to the Living Wage Foundation’s living wage. However, the latter is a voluntary rate calculated according to the cost of living, which currently stands at £8.25 an hour and £9.40 in London.

While the new rate has obvious implications for employers’ wage bills, particularly in traditionally low-paid sectors, organisations will also need to take into account employee benefits and remuneration policies when deciding how best to approach and comply with the national living wage.

Charles Cotton, performance and reward adviser at the Chartered Institute of Personnel and Development (CIPD), says: “Certain benefits are linked to base pay or earnings, such as pension contributions, death in service, and enhanced maternity leave, and these costs need to be factored in as well as the impact on the rise of pay elements such as overtime rates, unsocial hours and bonuses.”

Remaining compliant

In addition to cost considerations for earnings-related benefits, employers must also ensure that the cumulative take-up of benefits offered through salary sacrifice arrangements does not bring pay below the £7.20 rate. It is of note that the government has ramped up measures against compliance breaches, including increasing the penalty for non-payment of the national minimum and national living wage from 100% to 200% of arrears.

Employers should approach their payroll software provider to determine how they will help them monitor compliance, says Ian Holloway, head of legislation and compliance at Cintra HR and Payroll Services. The new rate will apply to pay reference periods beginning on or after 1 April 2016, which could require setting up new pay elements in the payroll system depending on whether organisations opt to comply by changing hourly rates or by topping up to £7.20, explains Holloway.

Reviewing pay structures

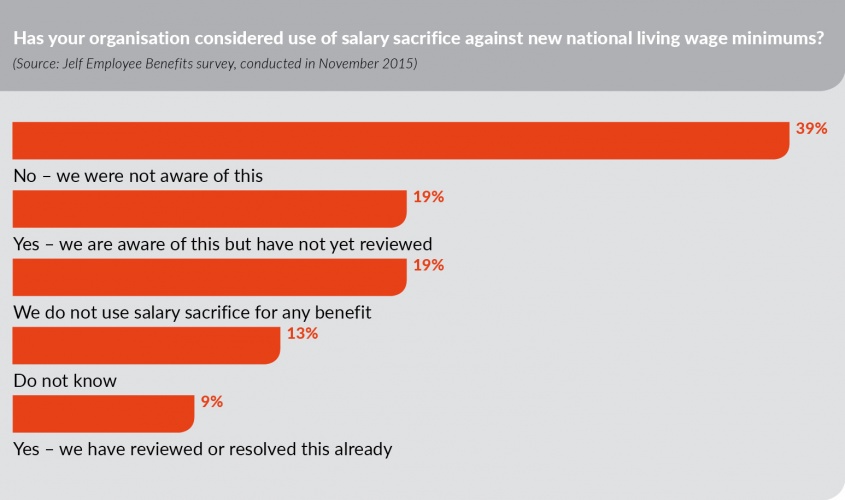

The new rate may trigger firms to examine their internal pay structure beyond those grades directly impacted by the national living wage, particularly where the gap between pay bands will narrow. Indeed, research by PricewaterhouseCoopers, published in October 2015, found that 57% of employers expect to spend more on their wage bill to maintain pay differentials between their lowest pay bands. Steve Herbert, head of benefits strategy at Jelf Employee Benefits, says: “Where [they] have a trickle-up effect on salary rates, it could be that employee benefits are used to differentiate between grades; finding something extra to give [higher-grade staff] that isn’t as expensive as increased salary might help here.”

Where financially viable, extending the £7.20 rate to all staff rather than just those aged 25 and over could help to prevent disengagement among younger employees. A number of high-profile employers have committed to paying all of their workforce at least the national living wage, and others are implementing a base rate above this or signing up to the higher voluntary living wage. Such measures can help to position organisations as employers of choice, providing an advantage when it comes to attracting and retaining talent.

Taking a strategic approach

There has been concern in some sectors that the higher wage bill could result in reduced headcounts, alternative staffing arrangements, or salary freezes among other areas of the workforce. In a bid to curtail costs, some organisations may consider adjusting their benefits offerings.

Duncan Brown, head of HR consultancy at the Institute for Employment Studies, says: “In the short term, it might lead to a de-emphasis on quite heavy fixed benefits packages, but over time I think it will encourage the trend towards more choice and employees and employers jointly investing in benefits.”

According to research by the CIPD and Resolution Foundation, published in November 2015, 16% of respondents plan to reduce overtime and bonuses to offset higher wage costs and 15% intend to raise prices. Yet almost double that amount (30%) plan to mitigate costs by improving efficiency and productivity, and this is where employee benefits have a key role to play.

“[Benefits] can drive competitive advantage in terms of encouraging higher productivity and wellbeing, which flows through to higher sales and revenues,” says the CIPD’s Cotton. “Hopefully organisations will look at this strategically and consider ways of using this as an opportunity to start looking at how we design jobs and work, and whether we can increase productivity that way rather than reducing the reward budget.”

Brown adds: “[Employers can] look at this in terms of the implications for reward strategies and how [they] can get the best return on this additional investment in staff.”

Taking a long-term, strategic approach is especially pertinent when considering that the national living wage is to increase to at least £9 an hour by 2020. Such an approach should consider the implications for employers’ broader reward and benefits packages, says Tom Hellier, UK practice lead, rewards at Willis Towers Watson.

Employers may also wish to address the new statutory rate by viewing it within the wider legislative context of pension changes, rising auto-enrolment contribution rates, upcoming gender pay gap reporting requirements, and whatever announcements the chancellor may have in store for the March 2016 Budget. Hellier says: “Rather than just looking at this legislation in isolation, [organisations could] consider what else is going on at the moment and take a more proactive stance on reviewing what [they] have and where changes might need to be made, rather than reacting piece by piece to legislation that’s coming out.”

Communicating changes

Whether or not employers opt to implement changes to pay and benefits beyond the legal minimum, the new rate of pay should be communicated to staff. According to research published in December 2015 by the Department for Business, Innovation and Skills, less than two-thirds (63%) of employers know who in their workforce is entitled to the national living wage and just 39% had communicated the change in pay rate to their employees. Jelf’s Herbert says: “Once organisations have worked out how they are going to [make the changes] and what benefits it’s going to affect, it’s important that, as with any major change, they communicate what’s going on.”

While communications will need to be handled sensitively where businesses are offsetting the increased wage bill through measures such as altered staffing arrangements and reduced or frozen remuneration packages elsewhere, they can also be seen as an opportunity to demonstrate the value of benefits programmes offered to staff. This might include details of benefits offerings that have been enhanced to support employee engagement and productivity in light of the national living wage, or an explanation of how salary-linked benefits will increase as a result of the higher hourly rate. “[Employers can show staff] that this is much more than just their base rates that are increasing because of the benefits package that they have,” says Hellier.

Starbucks UK to extend national living wage rate to all staff and offer London premium

All employees working in Starbucks UK-owned stores are to be paid at least the national living wage rate of £7.20, including apprentices and those aged under 25. The coffee chain’s all-employee approach to the new rate of pay will benefit more than 4,500 staff members.

From April 2016, baristas’ base pay will increase from £6.77 an hour to £7.20. In line with the increase in barista pay, Starbucks UK will also boost the hourly wage for supervisors from £8.20 to £8.72.

Lisa Robbins, director of partner resources UK at Starbucks, says: “We made the foundational decision that we didn’t want to differentiate on age, and we also wanted to make sure that we paid the right rate for the right jobs. So for those [employees] that are running shifts, we believe that they should continue to have the gap [in pay] that is there now in the future, which is why we decided to make that increase as well, to continue that recognition.”

The organisation informed staff about the change in pay rates through all-employee communications, supported by direct conversations between store managers and staff. When communicating about pay, the organisation also details the wider benefits and rewards available, such as training opportunities and its employee share ownership programme, Bean Stock.

Starbucks UK is also taking steps to help its staff address the rising cost in living. From April, the organisation will pay a premium to employees working in its London stores in recognition of the higher cost of living in the capital. It is also launching a financial awareness initiative and a rental deposit scheme, Home Sweet Loan. The rental deposit programme aims to offer a supportive, responsible route to housing by providing employees with an interest-free loan to put towards their first rental deposit, which is then repaid through their salary over 12 months.

Robbins says: “Socially we know that housing is a really hot topic and a real challenge, particularly for young people. We regularly listen to our [employees] and ask them what challenges they are facing. Last year we heard two things: the first was about the ability to get onto the housing ladder in an affordable way, and the other was about how Starbucks can help people develop to become more confident in themselves.”

In response to this feedback, Starbucks is expanding its apprenticeship programme and introducing core skills training to help staff develop their English language and maths skills.

Danwood introduces national living wage for all employees ahead of April deadline

Print and document solutions firm Danwood introduced the national living wage rate in January 2016, three months ahead of the statutory implementation date set by the government. Although the £7.20 hourly rate is only mandatory for those aged 25 and over, Danwood has established the national living wage as its base rate for all employees. The firm opted to take this approach to ensure a fair wage for all staff, particularly as a number of its business divisions have a wide age demographic. Around a third (29%) of the 3% of employees affected by the new rate are under the age of 25.

Jen Roberts, reward and benefits manager at the Danwood group, says: “It’s part of our commitment to our employees that we are going to honour a fair rate of pay for everybody, regardless of their age.”

Danwood communicated the new rate to staff ahead of the Christmas break. The reward team drafted communications for line managers so that they could sit down with affected employees and deliver the news face to face to provide a more personal touch. “We asked managers to do this because our managers are ambassadors to the business and they should be the bearers of good news,” says Roberts.

Further communications have been created for line managers to offer guidance around the national living wage, and an article on the subject has been posted on the organisation’s intranet site so that all staff can find out more information about the new rate of pay.

Danwood intends to conduct a review of its pay and grading structure this year, which will take into account the national living wage. The decision to introduce the rate early and for all staff is in line with Danwood’s #buildagreatplacetowork initiative, which will see the organisation review its benefits package over the next three years to reaffirm its investment in its 1,144 employees.

As part of its commitment to making Danwood a great place to work, a number of new benefits have already been introduced, including a bikes-for-work scheme in April 2015 and a pilot holiday purchase scheme in November 2015. The holiday scheme and associated communications campaign has had an especially positive response from staff, achieving a 19% take-up rate and amounting to 600 days of purchased holiday across the business thus far.

Viewpoint: Employers should consider the long-term consequences of their national living wage approach

Viewpoint: Employers should consider the long-term consequences of their national living wage approach

Since its announcement last summer, the national living wage (NLW) has rarely been far from the headlines. Commentators have discussed its merits and demerits, but whatever your opinion, it is a big deal: the Resolution Foundation estimates that it will result in a pay rise for roughly 4.5m workers.

But pay rises do not come for free. In a survey the Resolution Foundation commissioned of 1,000 employers, conducted in September 2015, over half expected the NLW to raise their wage bill. The crucial question for employers will be how best to respond.

A simplistic economic model suggests that if you raise wages you reduce employment. But most evidence on the UK’s minimum wage suggests employment has not been adversely affected. And while some survey respondents said they intended to reduce either hours worked or staff numbers, it was not the most popular answer.

Encouragingly, the most common response was to increase the efficiency of their businesses, the best possible response for workers and the wider economy. For some that will mean making more of the skills of their existing workforce. Others will choose to focus on whether their pay structure, in terms of differentials and bonuses, is set up to motivate employees.

Beyond higher productivity, some firms were considering price rises but recognised the risk of losing customers. Given the NLW only legally applies to those aged 25 plus, hiring more younger workers is an option but few employers intended to rely on this, preferring instead to operate a strategy of recruiting the best candidate for the job. For some employers it would be business as usual, absorbing the extra cost through reduced profits.

The survey also revealed that about a quarter of respondents had not decided yet. With April now not far away, it is vital that employers affected think through the long-term consequences of their strategy, rather than a short-term focus on cutting costs.

Conor D’Arcy is policy analyst at the Resolution Foundation