Need to know:

- Flexible benefits schemes must evolve to meet the changing needs of employers and employees.

- More data has become available, which can help employers to shape a flexible benefits strategy.

- Employers can draw on employee feedback and past behaviours to ensure the strategy is of value to their workforce.

The information that can be used to inform a flexible benefits strategy is never a certain set of data and decisions. As the requirements of both employers and employees change over time, flex schemes must also evolve to meet these needs.

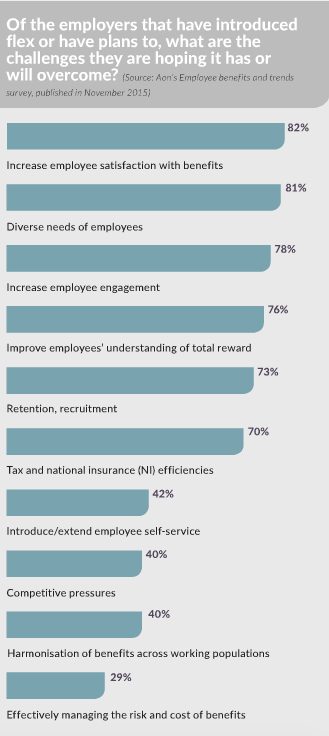

Employers recognise the importance of providing benefits to suit a workforce. Aon’s Employee benefits and trends research, published in November 2015, found that of the employers that have introduced, or plan to introduce, flexible benefits, 81% did so to address the diverse needs of employees, while 82% wanted the introduction of flex to help increase employee satisfaction with benefits.

Since its inception, the way in which flex schemes are designed has changed somewhat. Clare Sheridan, head of flexible and online benefits at Capita Employee Benefits, says: “When flex was first set up, it was only for the very big [employers]. It was very prescriptive, there were few providers in the market and it had a standardised set-up. As it started to evolve, there was a bit more intelligence around what sort of benefits [to include], more than analytics and demographics, it was looking at a balance between protection, lifestyle and savings benefits; making sure there was something for everyone but in a very broad-brush approach.”

As flex schemes have developed, more data has become available to employers that can be harnessed to inform their future strategies. Year-on-year experience can tell an employer which benefits employees valued, but also, in using its benefits advisers and consultants, an employer can draw on general take-up figures from its peers and from different industry sectors.

Organisational culture

The data that can be used to inform a flexible benefits strategy can be drawn from a range of sources, but it must always consider the right fit for an organisation and its workforce. Debra Corey, group rewards director at Reward Gateway, says: “Flex has changed so much and data has helped with that. Now there are so many things that can be flexed, [we] really need that data to help: it’s a combination of data and the organisation. What is [the] organisation’s culture and what are its values? What is its business strategy? What [is it] trying to do with [its] flexible benefits? That should be the framework.”

Collaboration among different stakeholders within an organisation can help to provide shared data, from which a flex strategy is just one outcome. A broader range of departments within an organisation now get involved in flexible benefits arrangements, including HR, health and safety, and the chief risk officer, says Andrew Woolnough, value proposition director at Willis Towers Watson. “Organisations should be starting to combine their various data sets: absence statistics, engagement surveys and employee claims experiences, for example,” he explains.

“It comes down to not just data, but collaboration with the people that own the data. If HR starts sharing data with other [teams] such as health and safety, and risk, it can start joining together other data sets; then it gets better data and better analytics. For forward-thinking organisations, it allows them to design an exciting benefits package to meet the employee risks that the [employer] faces.”

Employee input

Regardless of how long flexible benefits plans have been available to employers, a key step in forming a strategy would be to look at the demographics of employees, in terms of age profile, salary profile, and the geography, including whether or not there is a global strategy, says Corey. “Those are data points, not specific data,” she adds.

In addition, employees can be a valuable source of information, both in terms of providing input into what they would like from a scheme, or through the choices they have made in previous years. “I always do some form of data collection, whether that’s quantitative through questionnaires, or qualitative through focus groups,” says Corey. “[As a provider] Reward Gateway uses the management information it has on existing benefits to help understand how that’s working right now. For example, employees are saying they want flexibility but nobody is flexing or choosing anything. So [we] help the organisation understand, does it have the wrong things to flex? Are there things that would work better?”

Employers can work with providers and consultants to use that data in order to understand if they are actually getting the most out of the scheme as it currently stands. If, for example, an employer has too many benefits within its flex scheme and employees are not using them, the best thing to do might be to draw on the data to help market the scheme better and to get better utilisation rates. “To me, it’s all about balancing the data to have a really robust set so that [an employer] can come up with the most strategic, effective and impactful benefits,” says Corey.

Flex has now reached a stage where employers want their benefits schemes to be more intelligent in reflecting the needs of their employees. Drawing on the past behaviour of employees, organisations have a wealth of information available to them from which to form a flex strategy. Alex Tullett, head of benefits strategy at Capita, says: “We have over 13 years’ worth of decisions made by people in flexible benefits schemes. Those decisions are almost entirely socio-economic: they are about where [the employee] is at their point in life; and how much they earn. [We] can look at a large number of decisions and get an idea of what types of people appreciate or use certain types of benefits.”

That consumer decision-making data, combined with other employer data such as absence management statistics, enables an organisation to design a customised flex scheme. “We now see differences in the types of benefits that are available for different types of people, and looking at the way people engage with things like investments,” explains Tullett. “Bringing all of that [information] together increases the power of what is available quite materially, and actually allows [an employer] to start to predict and segment a workforce in such a way that it can start to target benefits more effectively, and reduce the unwanted spend. There’s no point in giving a benefit for people that aren’t going to use it.”

Technology has largely dictated the change in the model of flex in recent years, leading it more to an online benefits model, one that is, ironically, more flexible. Jon Bryant, director at Aon Employee Benefits, says: “[The industry] is taking a portal-based approach to online benefits, so the terminology of flex has changed somewhat. Flex is just one product that [an employer] can choose online.”

Instead of flex, it will be access to relevant benefits that are targeted, segmented and relevant to individuals, adds Capita’s Sheridan. “Flex as a concept isn’t relevant anymore; it’s [about] online benefits with flexibility on an individual level,” she explains.

Holiday Extras built flexible benefits scheme on employee input

Holiday Extras built flexible benefits scheme on employee input

The strategy behind Holiday Extras’ flexible benefits scheme has largely been driven by employee input and feedback.

Prior to launching its flex platform, My Extras, in 2012, the travel firm asked employees what they wanted from a platform and which benefits they would like to see. Anouk Agussol, head of people, says: “What we found from this, is that there was very little that stood out as the main things people wanted, and that we needed to provide benefits individuals want, not what the team as a group want.”

For example, a few employees wanted a payroll-giving scheme to be able to contribute to charity. “We introduced the benefit but the take-up is small,” says Agussol. “However, to the people that have it, it is really important to them so we wouldn’t take it away regardless of a small take-up. Benefits give value to an individual. If each person feels individually valued and feels the value of their benefits then they are more engaged.”

To form its flex strategy, Holiday Extras looked at the organisation’s culture and used feedback from the team to help decide which benefits to include.

“In addition, we also have an engagement survey called You are Holiday Extras. We get a lot of feedback via this to help shape our offering and we review our benefits each year,” says Agussol.

RWE NPower’s flex strategy uses data to help scheme evolve

RWE NPower’s flex strategy uses data to help scheme evolve

Energy firm RWE NPower soft-launched its flexible benefits scheme in November 2013 as part of its work on its employee proposition.

The organisation was aware that it needed to increase engagement among existing employees and give a more compelling proposition to attract new talent into the business. Reward was part of this development. Claire Tunbridge, reward manager, says: “The particular challenge we had was to enhance the benefits package and perception and appreciation among employees, without increasing cost.”

The organisation already had a number of fragmented voluntary benefits that were managed separately. “We felt we had very low employee awareness of those existing benefits,” says Tunbridge. “We had to duplicate communications, when we spoke about the benefits it was very disjointed and the administration was very labour-intensive. Introducing flex gave us an opportunity, we felt, to better position what we had already, to give employees a full picture of what they had already.”

The scheme, provided by Edenred, is available to RWE NPower’s 10,000 UK employees. An online platform allows employees to access their flex accounts from anywhere. This is important because a lot of employees, such as meter readers or renewable engineers, are not office based. “One of the challenges when we looked to do a flex scheme in the past was that all of our employees would be able to engage with it in an effective way,” says Tunbridge.

The scheme has achieved part of what it set out to by increasing engagement and awareness among employees. “We’ve seen some big improvements in employees’ perception of the benefits, even if they choose not to take some of the benefits that are available. For some people, it’s not for them, but we’ve had comments that say it’s great to see all these things that the [organisation] is making available.”

Now approaching its third annual enrolment, RWE NPower is drawing on the data it has gleaned in the scheme in order to shape its future provision. “As the scheme has matured, we’ve gone to the data more because we’ve started to develop an understanding of the types of profile of employees that we have around the business, and which particular benefits they are interested in and how to target those,” explains Tunbridge. “We’re being much more targeted about knowing which types of employees generally will choose certain benefits or are really engaged with the scheme.”

Learn more about the issues driving benefits strategy at Employee Benefits Live 2016 on 11-12 October at Olympia National, London