If you read nothing else, read this…

- A health cash plan is an insurance policy that reimburses the partial or full cost of an employee’s health treatment.

- They are a cost-effective benefit with which employers can offer employees wide-ranging workplace health and wellbeing support.

- The costs and cover of different health cash plans vary significantly between providers.

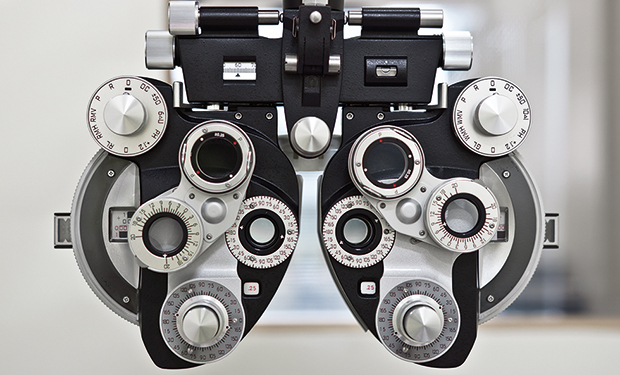

Health cash plans enable employees to access a range of healthcare treatments and services including employee assistance programmes and health screening. But optical, dental, hospital inpatient care and physiotherapy are the most popular treatments that employees claim for.

Another attraction of cash plans is their value for money because policyholders can claim back more than they spend on their annual premium. For example, Medicash offers Medicash Reward, which costs from just £1.25 per employee per week but entitles employees to claim up to, say, £220 per annum for dental cover.

Furthermore, employees are not required to have a medical before joining a plan, premiums do not increase with age and children under 18 are usually included for free as part of a parent’s cover.

Laing and Buisson economist Phillip Blackburn says: “Low cost cover, which can be claimed often, is something [employees] can really see value in. The plans can be introduced into the workplace in various ways, either through salary sacrifice, as a flex benefit or as a core benefit. Employees can cover a lot of their workforce and there is also a wide range of plans to choose from to suit individual needs.”

Cost-effective benefit

From employers’ perspective, health cash plans are a cost-effective way to support employees’ everyday healthcare needs at a time when low or non-existent wage increases are failing to meet their basic living costs.

Health cash plans can help employers to alleviate the financial strain that may arise from healthcare provision for employees and their families, reducing sickness absence rates and boosting staff retention and morale in the process.

Offering a health cash plan through a flexible benefits plan is particularly cost effective as it helps employees to tailor a plan to their specific needs.

The main cause for working days lost in 2013 was musculoskeletal conditions, such as back and neck pain, leading to 31 million days lost. The next most common cause was minor illnesses, such as coughs and colds (27 million days lost), followed by stress, anxiety or depression , at 15 million days lost.

Health cash plans can offer support for employees affected by stress, anxiety and depression, such as counselling. Providers often offer counselling through employee assistance programmes (EAPs).

Another attraction of health cash plans for both employers and employees is their stable pricing, despite the fact that many providers have substantially enhanced their products and services over the last few years.

But prices are not expected to remain low for long due to the industry’s desire for plans to be seen as more than a cheap alternative to healthcare benefits such as private medical insurance (PMI), particularly given cash plan providers’ recent innovation.

Product innovations include value-added services

Cash plan innovation in recent years includes value-added services , which in addition to EAPs and employee helplines extend to access to services such as Best Doctors. Both Medicash and Westfield Health have added the Best Doctors service to their cash plans, which allows employees to obtain expert medical advice about their health complaints.

Some providers are also offering services to support employee wellbeing. For example, Health Shield enables employees to claim for nutritional therapy and Indian head massage, providing a recognised practitioner delivers the treatment.

Some health cash plans can also be used to cover PMI excesses, but some industry critics consider this as a misuse of the benefit.

Accordingly, Medicash and Simplyhealth now offer cover specifically for PMI excesses. Medicash’s Proactive plan offers £200 worth of cover that employees can use to pay excesses or for specialist consultations and diagnostic tests.

Wider medical cover is now available

Health cash plans’ association with PMI is clearly unavoidable, and increasingly so as some providers attempt to bridge the gap between the two benefits. For example, Westfield Health’s Hospital Treatment Insurance, which it launched in April 2012, can be added to its cash plans to enable employees access to medical and surgical procedures. And Perfect Health’s surgical cash plan offers employees access to over 1,500 surgical procedures.

The ability to combinecash plans with hospital treatment insurance enables employees to access continuous healthcare treatment and avoid National Health Service waiting lists. The benefit for employers is that their staff get quicker access to top-notch treatment, enabling them to get well and return to work quicker. Furthermore, early diagnosis can make many illnesses much easier to treat, which also reduces employees’ recovery time.

A health cash plan also helps to make staff feel valued, according to the Employee Benefits healthcare research 2013, published in June 2013. The research also found that the majority (61%) of respondents said that cash plans help them to feel well perceived by staff.

Cash plans are often considered more suitable for younger staff

Health cash plans are often considered more suitable for younger staff, especially those who may not see the full value of PMI because they are relatively fit and healthy.

Some employers provide cash plans to employee groups that do not receive PMI, while others offer them to all staff. Obviously, funding is an issue and some employers may not be in a position to offer either benefit to all staff.

The facts

What are health cash plans?

A health cash plan is an insurance policy that reimburses the full or partial cost of an employee’s health treatment, such as an optician’s appointment or a dental check-up. An employee can only reclaim the cost of their treatment from their cash plan provider following the treatment.

Cash plans offer employees inclusive healthcare for as little as £1 per week to several hundred pounds annually. They can be purchased as standalone products or with hospital treatment insurance, which provides continuous health cover at a fraction of the cost of comprehensive private medical insurance.

Employers can use cash plans to tackle the causes of staff sickness absence and to help boost employee engagement. This low-cost, flexible benefit also helps organisations to meet their duty-of-care requirements around staff health and wellbeing.

What are the origins of cash plans?

Cash plans date back to the 1870s when employees paid 1p in every pound they earned to access healthcare. Early plan providers settled bills directly with hospitals until the National Health Service was created, after which insurers reimbursed employees directly.

What are the costs involved?

Cash plans start from around £1.25 per employee per week.

What are the tax issues?

Employer-paid health cash plans are treated as a benefit-in-kind for tax purposes and the value of the benefit is determined by the premium paid rather than the cash that is repaid to an employee.

What are the legal implications?

There are no legal implications associated with a cash plan, although an employer can use one to help fulfil its duty-of-care requirements to employees’ health and wellbeing.

Where can employers get more information and advice?

The British Health Care Association, a trade body representing not-for-profit healthcare, has information regarding cash plans, including most of the UK’s cash plan providers , on 01343 830148.

Which providers have the biggest market share?

Laing and Buisson’s Blackburn says: “Simplyhealth is the market leader by some way, accounting for 40-50% of the market. Westfield Health is second largest, then BHSF, Health Shield Friendly Society and HSF Plans.”

What have the main cash plan providers been up to over the past year?

Health Shield has strengthened its market position by increasing its income from £27m to £29m in 2013, according to another Laing and Buisson’s report, The health cover UK market report 2014, which was published in July. The report found that not only was non-profit Health Shield the only top four provider to increase its market share by income every year for the previous five years, but that it was the only provider to have made a noticeable share increase in 2014.

Statistics

- 1 in 10 (9%) of business drivers fail to wear required eye-wear. (Brake, Specsavers and RSA Survey, August 2013)

- The primary dentistry care market is worth £5.7 billion annually. (Laing and Buisson, Health Cover UK Market Report 2014, January 2014)

- 52% of consumers are worried about being able to afford future dental care. (Simplyhealth Dental Survey , April 2013)

Discount Authentic Designer Handbags

Coach Bags For Sale

http://www.genexco.com/peahenmon6o5yup.asp http://www.genexco.com/stancemont9lsbs.asp http://www.genexco.com/stancemont8kic8.asp

Coach Factory Outlet Online Store

Coach Factory Store Online

Coach Handbags Online

Coach Key Fob

Handbags Cheap

Coach Shoe

Silver Coach Purse

Coach Outlet Las Vegas

Leather Handbags

Leather Purses

Purses And Handbags

Coach Poppy Shoes

Coach Canada

Coach Bags Outlet

Coach Wallets For Women

Designer Handbag Brands

Coach Satchels

Coach Wedge Shoes

Designer Handbags On Sale

Black Leather Purse

Coach Store

Coach Outlet Michigan City

http://www.awelectric.biz/flound/allegiancemonr70qcg.asp http://www.awelectric.biz/flound/allegiancemonrnwc26.asp http://www.awelectric.biz/flound/ allegiancemonrzv8q8.asp

http://www.awelectric.biz/flound/allegiancemonrqag7i.asp http://www.awelectric.biz/flound/allegiancemonr2c0qc.asp http://www.awelectric.biz/flound/ allegiancemonr6kw3k.asp

https://sert555.no/floud/provisionmon6y1hbd.asp https://sert555.no/floud/provisionmon6au71y.asp https://sert555.no/floud/ provisionmon6nbd7d.asp

https://sert555.no/floud/herdmon19hzsi.asp https://sert555.no/floud/herdmon1tj26b.asp https://sert555.no/floud/ herdmon1by4oi.asp

http://www.homosassahistory.org/Images/allegiancemonrqag7i.asp http://www.homosassahistory.org/Images/allegiancemonr2c0qc.asp http://www.homosassahistory.org/Images/ allegiancemonr6kw3k.asp