If you read nothing else, read this…

- Workplace savings platforms allow employees to bring together their financial products to give them an overview and insight into their wealth.

- While some platforms offer access to a range of savings and investment products, others allow employees to pull together different products, including current accounts, credit cards and mortgages.

- Changes to pensions will drive take-up of these platforms, with employers looking to help employees who might be caught by the new rules.

But, while plans for these platforms may have been mothballed while employers dealt with pensions auto-enrolment, this integrated approach to an employee’s finances is becoming increasingly commonplace.

Although some platforms focus on providing additional savings vehicles such as individual savings accounts (Isas) or investment accounts to mop up any excess funds or money that cannot go into the pension, the latest generation go a step further. These allow employees to import all of their financial products, including their current accounts, mortgage and loans.

While many employees may previously have shuddered at the thought of bringing all of their personal finances into the workplace for fear of revealing too much to their employer, this is no longer an issue, says Mark Rowlands, head of defined contribution (DC) services at Mercer. “More and more employees want to be able to have all of their finances in one place so they can see instantly whether they’re on track,” he says. “They’re also much more comfortable with the technology, which has helped to remove any fears about their employer accessing their data.”

Jon Bryant, director of Aon Employee Benefits, adds that having this single view of all finances delivers a number of benefits to employees. “By giving [employees] an overview of where [they] are financially, these platforms can help [them] make much more informed decisions about [their] finances,” he explains. “As an example, our platform, Bigblue, can analyse [their] income and spending data from credit cards and current accounts to provide [them] with ‘safe-to-spend’ and ‘safe-to-save’ limits.”

Platforms also enable employees to have greater control over their finances. For instance, rather than having a series of pensions from former employers, an employee can transfer them all to one platform and see exactly what they have saved and where it is invested.

Online tools help bring an employee’s finances to life too. Nathan Long, head of corporate pensions research at Hargreaves Lansdown, explains: “Left to their own devices most employees won’t save enough for the retirement income they want so we’ve included tools and education to show them what their savings will be worth in retirement. This can really encourage them to save more.”

Pension changes

While these benefits are compelling, changes in the workplace are set to drive demand. Rowlands explains future pension changes are a major catalyst. “The reduction in the lifetime allowance to £1m next April [2016] is going to affect around 10% of employees, either because they’ve already built up a large fund or they’re likely to hit the limit,” he says. “Being able to see what [they’ve] already saved, and have access to other savings vehicles, will be increasingly important.”

High-earning employees will also be hit by changes to pensions tax relief that were announced in the Summer Budget in July 2015. With this, anyone earning over £150,000 a year will see the £40,000 annual allowance reduce by £1 for every £2 of income, until they only have a £10,000 allowance on which they will receive tax relief.

And, with the government consulting on tax relief on pensions, which could affect the relative attractiveness of different savings vehicles, this will make it increasingly important to offer employees a variety of savings options.

Bigger benefits

There is also demand from employers. As pensions are now the norm in the workplace, employers are looking for ways to spice up their benefits package to help them attract and retain the right people. Minh Tran, senior DC and wealth consultant at Towers Watson, says: “Employers are recognising that they have a very diverse range of employees, often with very different financial needs.”

For example, for the younger generation of employees, aged 20 to 39, pensions are not considered a top financial need, while older employees place more importance on general bills than pensions.

Recognising the increased demand, there is also more competition in the platform market. This is leading to better terms and greater product innovation, says Tran. “This is great for employers and their employees,” he adds. “We’re seeing providers offering preferential rates through these platforms, and even allowing employees to retain them if they leave. The propositions are much more compelling.”

Technological advances

Technology has also helped to drive take-up of workplace savings schemes. While systems and data issues used to make it difficult to link into different providers’ products, the latest platforms use the same technology as the aggregators to give users a seamless experience. “Platforms are much slicker now with digital interfaces to allow employees to log on from home or on the move,” says Rowlands. “We’ve also made our platform modular to allow employers to turn on what they want, when they want. This helps to ensure employees don’t feel overwhelmed.”

And this is just the beginning. Platform providers are already talking about the next wave of developments, with greater levels of interaction, education and personalised messaging and nudges all on the cards to help employees be more financially savvy.

Viewpoint: Employers have a responsiblity to support employees with financial education

Viewpoint: Employers have a responsiblity to support employees with financial education

There are many examples of benevolent employers that have attended to their employees’ welfare beyond the work place. Joseph Rowntree and the Cadbury family are exemplars of such benevolence, providing housing, health services and pension schemes for their employees. But when it comes to their employees’ welfare, should contemporary businesses be providing general financial education to their staff?

Research published by Secondsight in October 2014 found that 67% of the working population receive no financial education from their employers. Only 20% of employees had a coherent financial plan and a third claimed to have only a vague idea about money management. Half of employers surveyed said that their staff have asked for help with financial education.

Providing help would be good citizenship but could it make good business sense too? Money worries are the most common cause of keeping people awake at night. Certainly financial competence reduces the risk of getting into money problems and is therefore conducive to greater productivity by reducing stress levels.

However, many organisations do not have the resources and skills to provide such training and they may be wary about intruding into their employees’ financial circumstances.

Martin Upton is director at the True Potential Centre for the Public Understanding of Finance, the Open University Business School

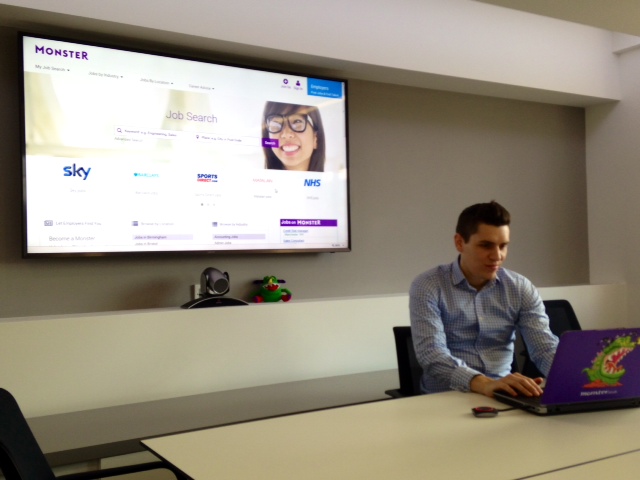

Case study: Monster introduces workplace savings platform to help staff understanding of finances

Case study: Monster introduces workplace savings platform to help staff understanding of finances

When recruitment firm Monster started preparing for auto-enrolment, its senior director for human resources, Claire Lock, got a bit of a shock.

“We’d been offering a generous pension scheme but only 41% of staff had signed up,” she explains. “Employees didn’t really understand its value or the implications of not saving for the future.”

To change this, the organisation introduced a workplace savings platform, Aon’s Bigblue portal, in June 2014. As well as detailing all of its employee benefits, this includes a financial management tool that allows employees to get an overview of their finances. “Employees can import everything, including their savings, credit cards and mortgages and see their net worth. It will also analyse spending and savings habits, which can be a real eye opener,” Lock adds. “I’ve already increased my pension contributions on the back of the information it gave me on my retirement income.”

And she’s not the only one. Ninety-eight per cent of the firm’s 280 employees are now members of its pension scheme and, while auto-enrolment will have helped drive this, 78% also log on to the portal and 72% have taken advantage of its salary sacrifice arrangements. “We’re really pleased with this level of engagement,” Lock says. “It was important for us to help employees gain a better understanding of their finances and be a differentiator in the market.”

Case study: Martin Currie offers greater savings flexibility with new platform

Case study: Martin Currie offers greater savings flexibility with new platform

Offering employees greater flexibility around how they save and broader access to the fund market were the key reasons behind investment management firm Martin Currie’s decision to introduce a workplace savings platform in 2013.

Craig Gibson, head of reward, explains: “We offer all our employees membership of our self-invested personal pension (Sipp) to help them save for retirement but we know that some might be saving for other goals such as a deposit for a new home or a child’s education.”

To make it as easy as possible to do this, the employer introduced Hargreaves Lansdown’s Corporate Vantage platform, offering employees access to a range of savings and investment products, including an individual savings account (Isa) and a share account alongside the Sipp.

Having access to these additional products has proved popular, with around a quarter of employees also holding a further product on the platform. Gibson expects this will increase further in the next couple of years. “The changes to pension rules are likely to result in more employees looking at different options for their long-term savings,” he says. “It’s good to know we’re already offering this flexibility through the platform and catering for our employees’ current and future needs.”