Just 6% of employee respondents are on track for the retirement income they want, despite the focus on pensions following the reforms announced in this year’s Budget, according to research by Aegon.

Its second Aegon UK Readiness report surveyed 4,000 UK employees to assess their behaviour, awareness and finances to determine their readiness score, which provides a mark out of 100 to indicate how ready a person is for retirement.

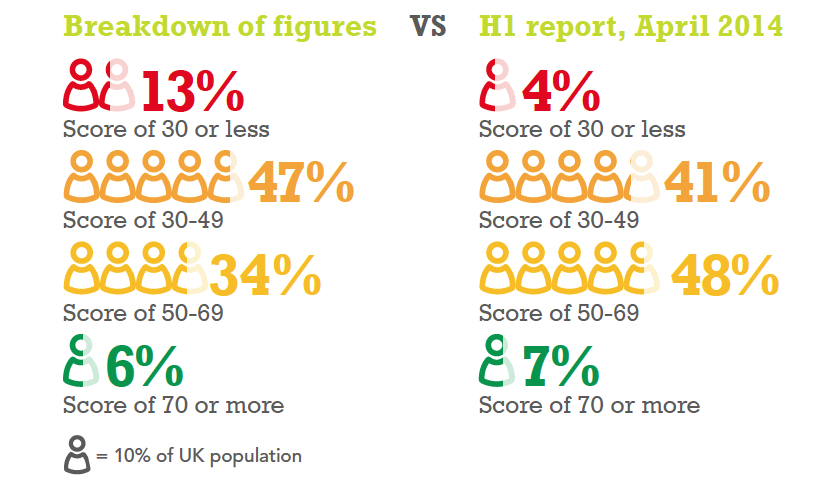

The average readiness score among respondents has fallen from 52 out of 100 to 47 since April.

The main driver behind the decrease is a rise in people’s expectations of income in retirement, with employees wanting an average of £41,000 a year compared to £35,000 in April.

The number of employees scoring a readiness score of less than 30 has also increased from 4% to 13%.

However, the research found that nearly a third (32%) are more confident about pensions following the Budget reforms.

Only 4% believe the changes are for the worse, with 64% unmoved in their view.

The report also found:

- 50% of respondents have never checked the performance of their retirement savings.

- 47% do not make any regular contributions to a pension.

- 30% know the value of the current maximum state pension of £113.10.

- 25% overestimate the amount of the maximum state pension they will receive.

David Macmillan (pictured), managing director of Aegon, said: “The Chancellor radically changed the way people will be able to access their pension with his Budget announcements.

“It’s possible however, that the positive news has increased people’s expectations about what they can expect to receive in retirement, when, in actual fact, the main factor which will determine their income in retirement will be how much they save each month.

“There’s a gulf between the amount of money people want in retirement and what they are likely to get. People need to be realistic with their goals, but the pensions industry must support them to achieve this by providing simple products they can access online and via a mobile device.

“In addition to expectations, people’s financial awareness and knowledge is still relatively low as only 30% know the value of the current maximum state pension, £113.10, with 31% overestimating the figure which will make up a major part of many people’s retirement income.

“However, there are signs that awareness and behaviours will improve as implications of the new pensions and saving changes filter through. For example, the amount people have saved in individual savings accounts (Isa) has leapt from an average of £8,200 in April to £12,700, indicating people are trying to make the most of the new increased £15,000 Isa limit.”