There are various ways employees can be given access to cars, but employers must decide which best suits their business needs

If you read nothing else, read this…

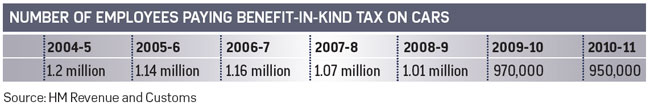

- The number of staff paying benefit-in kind tax on cars has fallen as employers change their approach to fleet.

- Alternatives to company cars include: car sharing, car pools, employee car ownership, cash allowance and grey fleet.

- Fleet arrangements should be selected according to how well they enable employees to do their jobs effectively.

HM Revenue and Customs (HMRC) statistics published in July 2012 show that the number of employees paying benefit-in-kind tax on cars, which applies when a car is used for private purposes rather than solely on a job-need basis, fell from 1.2 million in 2004/5 to 950,000 in 2010/11, which suggests employers are offering fewer company cars to staff.

But John Lewis, chief executive of the British Vehicle Rental and Leasing Association (BVRLA), says: “It is true that the number of people paying benefit-in-kind tax has come down, but it is not true that the number of cars has come down because [employers] are looking at different ways of running them.”

Alastair Kendrick, a director at MHA MacIntyre Hudson, says this is because some UK businesses are under pressure from their US parents to reduce the number of cars they offer to employees. “US parent [organisations] cannot understand why the UK has this requirement to give company cars because it does not happen in other countries,” he says. “If you go across Europe, it is common to provide cars for business need, but nothing else.”

So what options are employers exploring? One approach is a central pool of leased cars for staff to use for work-related travel. Lewis says: “Some arrangements allow employees to rent the car for the weekend, although they have to pay the rental firm, otherwise it will be a benefit in kind.”

Car hire arrangements, offered by providers such as Zipcar, are also popular. Dan Rees, a senior manager at Deloitte Car Consulting, says: “Zipcar and car sharing work well in cities where people may not need a private car.”

Car sharing arrangements

Car-sharing arrangements can be made via online networks, which allow employees working for different organisations across the UK to post details of any business journey they are taking, so others needing to travel in the same direction can catch a lift. But Lewis says employers must ensure their insurance company is happy with this arrangement.

A more traditional alternative to the company car is a cash allowance, whereby employees are given the money, typically in monthly instalments, to buy their own car.

However, Lewis says that in the current economic climate, employees will get less value for their money, which increases the likelihood of problems arising when they try to secure credit to buy a car. The financial climate also makes it more difficult for employees to keep their car properly maintained and insured for business use.

Employee car ownership schemes can address such issues by allowing an employee to spend a certain amount of cash on a car. The employee signs a contract with a car leasing company to buy the car over a set period and mileage. Such agreements typically run for two or three years and include servicing, maintenance, road tax, breakdown recovery and insurance.

Whatever an employer’s preferred option, the priority should be enabling employees to do their job effectively. Deloitte’s Rees says: “Some employees need to press flesh. They need to be able to go and see people and build relationships. That is just a reality. People need to get around to do that.”