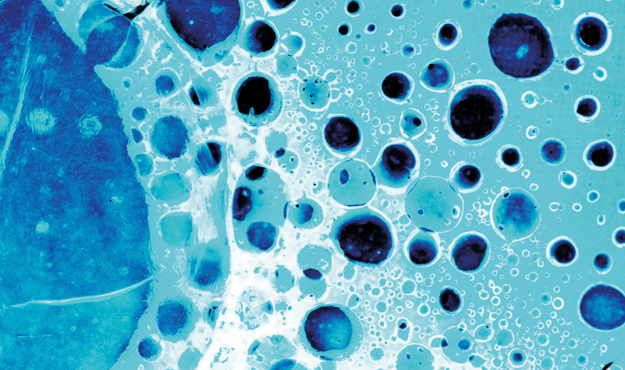

With the group risk industry increasingly reporting the amount and percentage of claims it pays out each year, Employee Benefits investigates the top ailments for claims via group life assurance, group income protection and critical illness insurance.

Looking at data shared by the UK’s leading group risk insurers, it is clear that cancer and heart disease top the list for group life assurance claims. For critical illness insurance claims, cancer and heart issues also lead the way, with heart attacks ranking second and strokes coming third. Meanwhile, group income protection claims are most often for cancer, mental health issues or musculoskeletal problems.

According to research by Group Risk Development (Grid) published in May 2014, the group risk industry paid out £1.24 billion in 2013, up slightly from the £1.2 billion paid out in 2012. A total of 24,102 claims were made.

The research showed that the main causes for claims under group life assurance were for cancer (46%) and heart disease (17%). Through group income protection, the most common claims were for cancer (25%) and mental illness (24%), and through group critical illness insurance, cancer (69%) and heart attacks (10%) elicited the most claims.

Employee Benefits asked each of the main providers of group risk benefits which conditions resulted in the most claims among their employer clients.

If you read nothing else, read this…

- The top ailments for group life assurance claims are cancer and heart disease.

- The top ailments for group income protection claims are cancer, mental health issues and musculoskeletal problems.

- The top ailments for group critical illness claims are cancer and heart issues.

Friends Life

- Group life assurance – cancer, heart disease, cerebrovascular accident.

- Group income protection – mental illness, musculoskeletal, cancer.

- Critical illness insurance – cancer, heart attack, stroke, multiple sclerosis.

Source: Friends Life’s top ailments for group risk claims in 2013.

Canada Life

- Group life assurance paid out as lump sums in 2013 – cancer (52%), heart (10%), miscellaneous (9%).

- Group income protection claims paid out at 31 May 2014 – mental and nervous disorders (26%), musculoskeletal (24%), cancer (12%).

- Critical illness insurance claims in 2013 – cancer (66%), heart attack (11%), stroke (6%).

Source: Canada Life Insurance Group, June 2014.

Aviva

- Group income protection – cancer, psychiatric and musculoskeletal.

- Group critical illness insurance – cancer, heart attack and stroke.

Source: Aviva’s claims paid in 2013.

Unum

Group life assurance – cancer (54%), ischaemic heart disease (17%), other (9%).

Group income protection – mental health (29%), cancer (18%), musculoskeletal (10%).

Group critical illness insurance – cancer (63%), heart attack (13%), multiple sclerosis (8%).

Source: Unum’s top ailments for claims received in 2013.

Ellipse

Group life assurance claims paid out in 2013:

- Cancer – 36%

- Heart/circulation illnesses – 16%

- Respiratory illnesses – 12%

Source: Ellipse

Aegon

- In 2013, 80% of critical illness claims and 59% of life assurance claims from women were for cancer.

Source: Aegon

Zurich

- In 2013, out of 599 claims paid under group life assurance, 274 were for cancer, 83 were for Ischaemic heart disease and 42 were for accidents.

- In 2013, out of 89 claims paid under group income protection, 28 were for mental illness, 20 were for cancer and 10 were for musculoskeletal issues.

Source: Zurich UK Life