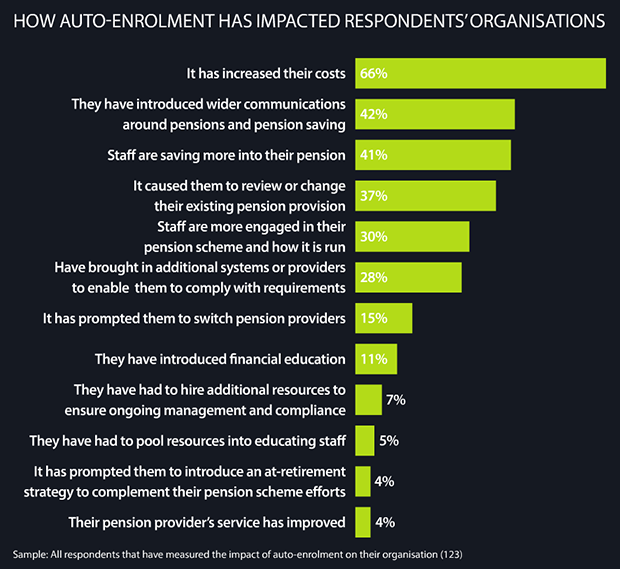

Two-thirds of respondents (66%) that have measured the impact of auto-enrolment within their organisation say compliance has increased their costs, according to the Employee Benefits/Close Brothers Pensions research 2014, which surveyed 216 respondents in September 2014.

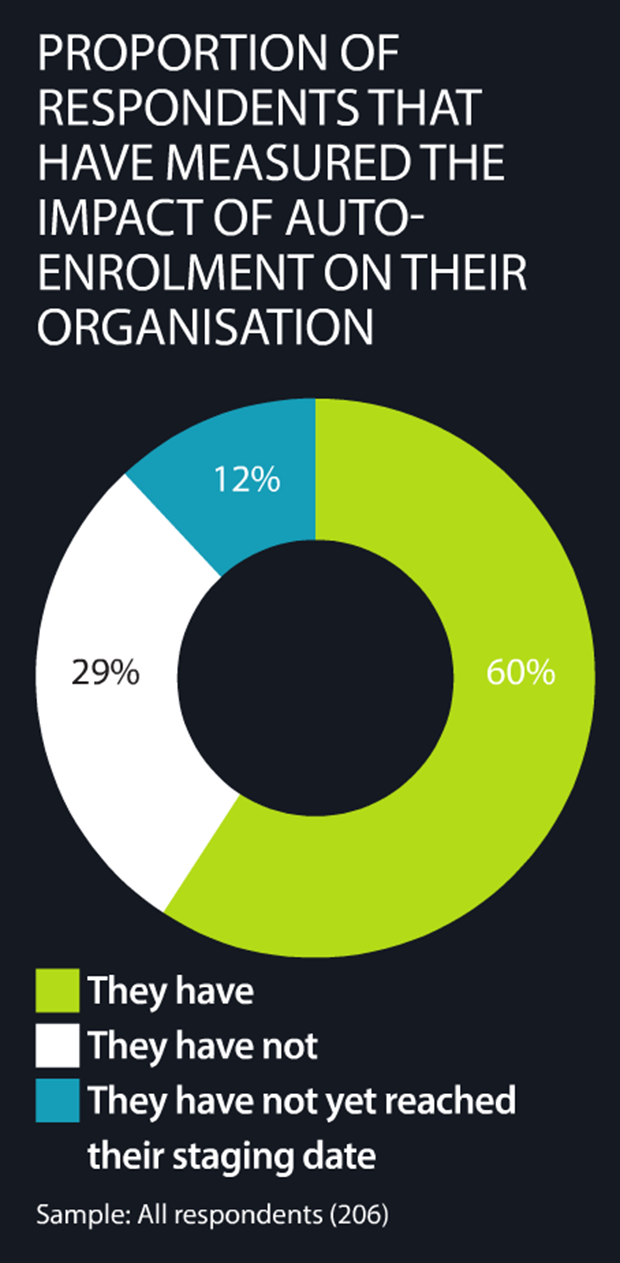

Overall, 60% of respondents have measured the impact of auto-enrolment on their organisation. A further 12% have yet to reach their staging date.

This increase in costs is in line with employers’ expectations before auto-enrolment came into effect in October 2012. For example, just under three-quarters (74%) of respondents to the Employee Benefits Workplace savings and pensions research 2011 expected compliance with the legislation to increase costs for their organisation.

Some of these costs may result from the additional resources and technology systems that respondents have had to implement to meet the demands of auto-enrolment or from the introduction of initiatives such as financial education or an ‘at-retirement strategy’.

Overall, however, auto-enrolment appears to have had a positive impact on employers, with 42% having introduced wider communications around pensions and pension savings, 41% reporting that staff are saving more into pensions and 30% seeing increased staff engagement with their workplace pension and how it is run.

Sample: All respondents that have measured the impact of auto-enrolment on their organisation (123)

can i buy viagra without prescription when viagra stops working http://fast-sildenafil.com/ – Buy Viagra Online who invented viagra generic online viagra Sildenafil generic viagra online fast delivery free trial viagra http://fast-sildenafil.com/ – Sildenafil. viagra gag gift viagra at costco