EXCLUSIVE RESEARCH: Employees have mixed levels of understanding about the pension reforms, according to the Employee Benefits/Close Brothers Pensions research 2015.

The reforms, which came into force in April 2015, give pension scheme members over the age of 55 greater freedom in how they can access their pension savings. Further changes around lifetime and annual allowance limits are due to come into effect in April 2016.

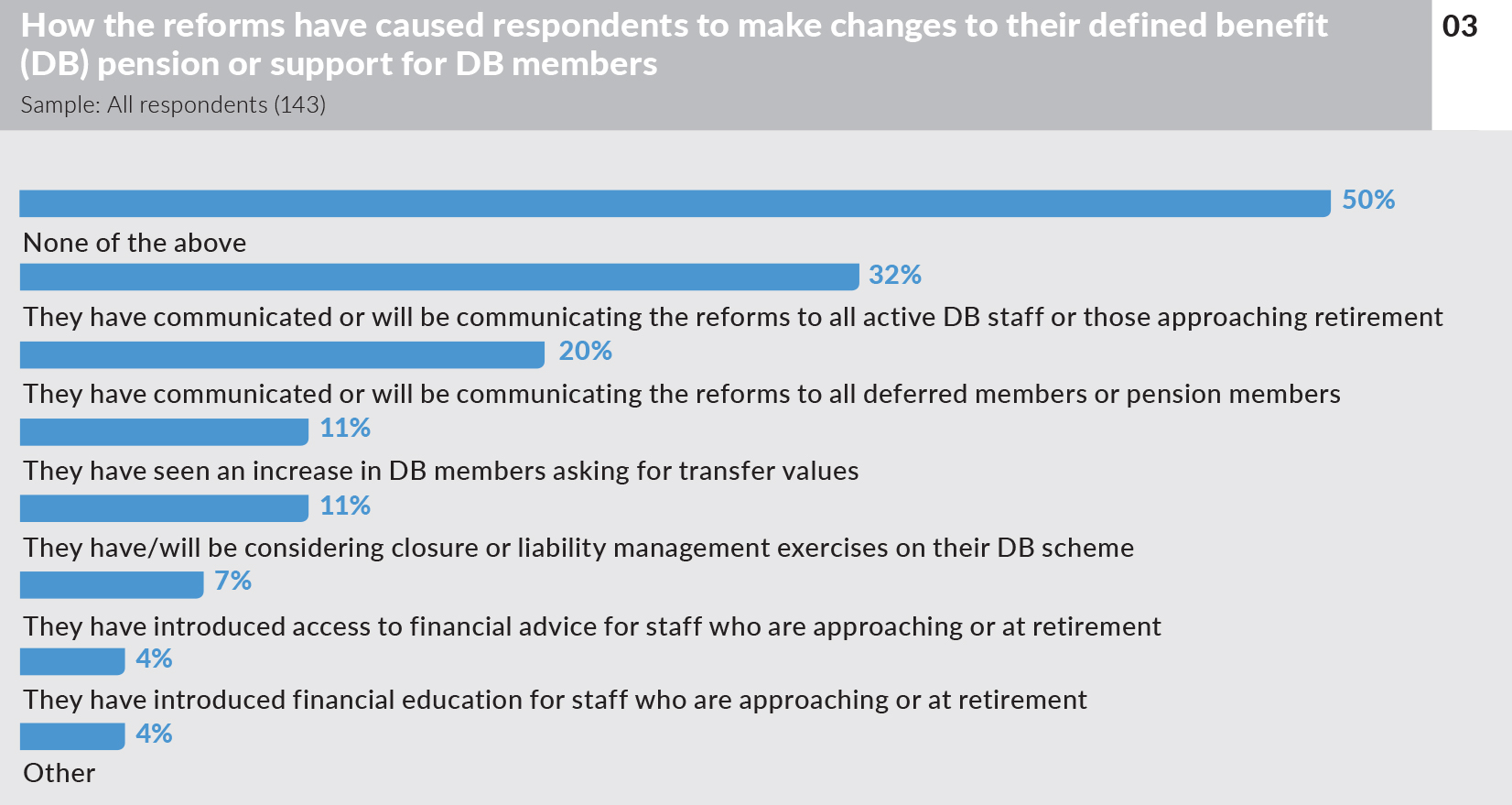

Around half (51%) of respondents say staff have demonstrated a partial understanding of the reforms, 18% believe employees have shown a good level of understanding and 18% report a poor level of understanding. Perhaps more telling, however, is that 14% of respondents do not know what level of understanding staff have shown around the new flexibilities.

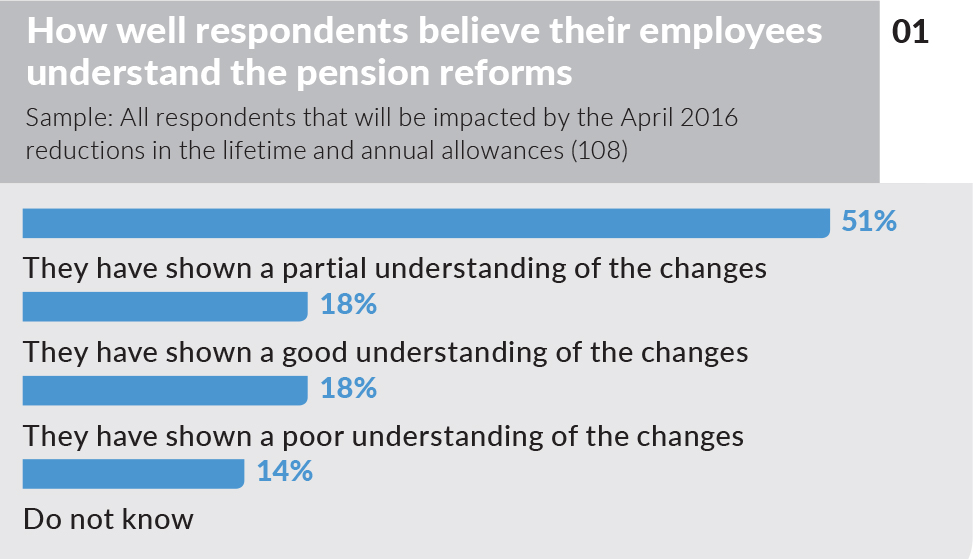

More than half (52%) of respondents have communicated the pension changes to all employees or those approaching retirement as part of changes made to their defined contribution (DC) provision in light of the new flexibilities.

Almost half of (48%) of respondents in the Employee Benefits/Close Brothers Pensions research 2014, published in November 2014, believed that April 2015’s changes would result in more staff wanting and needing guidance around their pension decisions at retirement. In addition, 43% of respondents expected an increase in the number of staff requiring pensions guidance throughout their career.

Indeed, a number of respondents to this year’s survey, which was conducted in September 2015, offer pensions engagement, communications and guidance-centred initiatives in response to the reforms.

Just under a fifth (19%) have introduced financial education for staff at, or nearing, retirement in response to the pension reforms, and 18% now provide these groups with access to financial advice. Meanwhile, 27% have begun or already increased pension engagement exercises for all employees and 27% are referring all employees to the government’s Pension Wise service.

While just 6% of respondents have implemented new drawdown or annuity services under changes to DC pension schemes prompted by the new flexibilities, 24% either already have changed or plan to change their DC pension scheme to allow staff to drawdown or take cash withdrawals.

Defined benefit members are informed of pension reforms

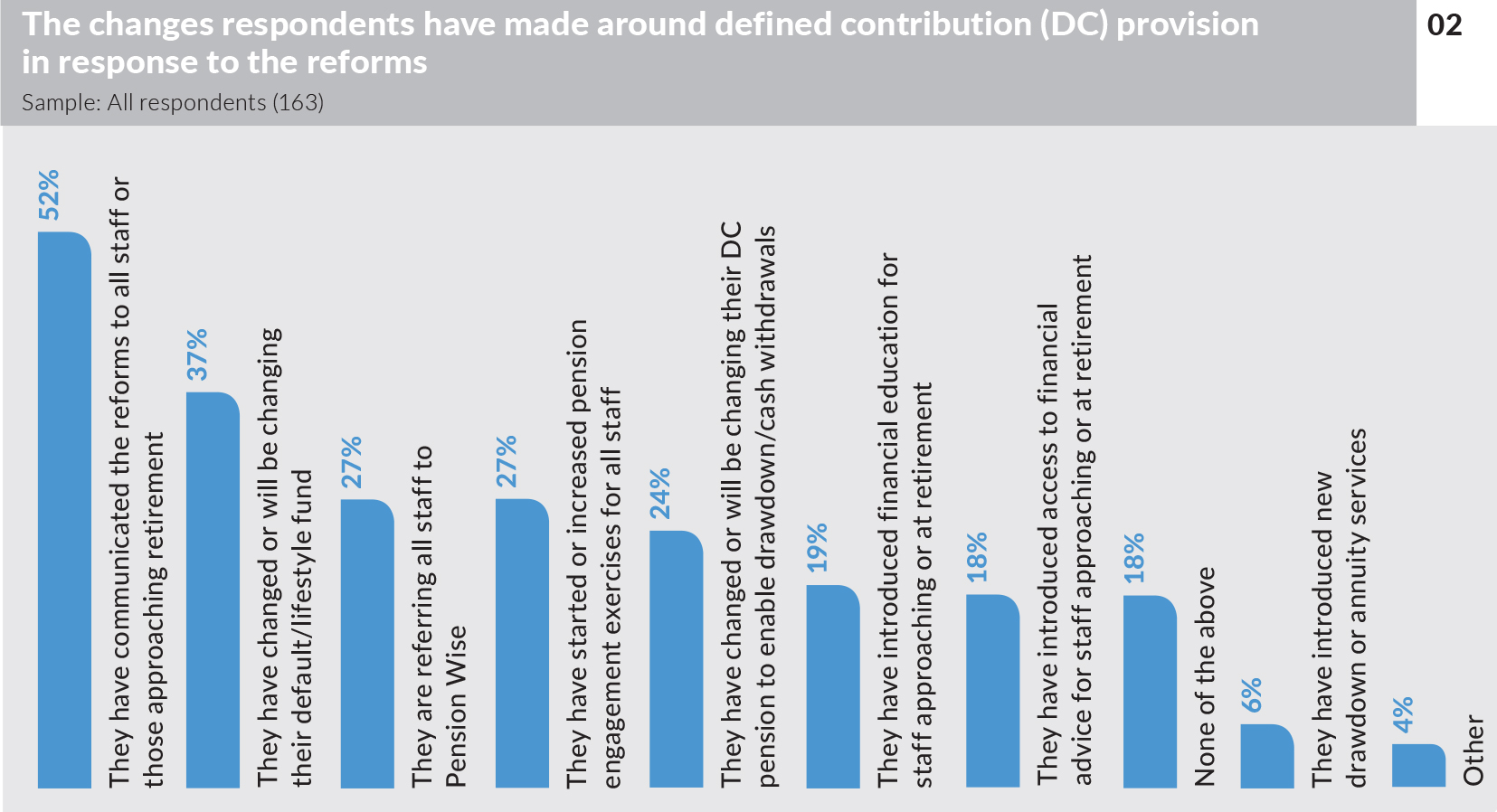

Communication is high on the list of support measures employers offer to defined benefit (DB) pension scheme members, with 32% communicating, or planning to communicate, the pension reforms to active DB scheme members and those approaching retirement.

A fifth (20%) of respondents are informing deferred and pension members about the changes that came into effect in April 2015. But just 4% of respondents are using financial education for those approaching retirement as a means of supporting DB members in light of the pension changes, and just 7% have introduced access to financial advice for employees at or nearing retirement.

One in 10 respondents (11%) are considering closure or liability management exercises on their DB pension schemes, with the same percentage reporting an increase in DB members asking for transfer values.

Half (50%) of respondents are not implementing any of the measures discussed above. This may be an indication that they are not making any changes to their organisation’s DB schemes or offering additional support to DB members in response to the reforms, or it may be that they do not have a DB scheme in place.