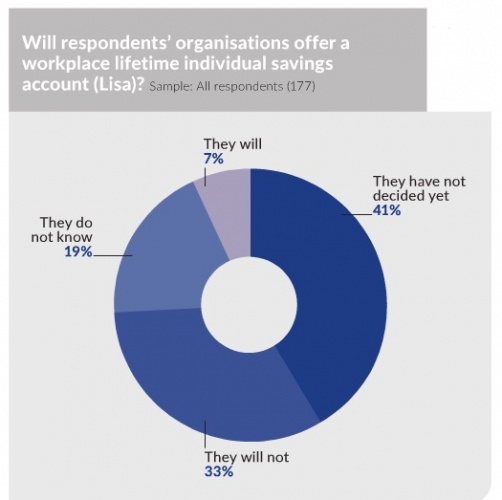

EXCLUSIVE: A third (33%) of employer respondents do not plan to introduce the lifetime individual savings account (Lisa) as a workplace savings tool, according to research by Employee Benefits and Close Brothers.

The Employee Benefits/Close Brothers Pensions research 2016, which surveyed 250 employer respondents, found that just 7% plan to offer the Lisa to their employees, while 42% remain undecided.

The Lisa, which was unveiled by former Chancellor George Osborne in the March 2016 Budget, will be available to individuals aged 18-40 who will be able to save up to £4,000 a year into the savings vehicle until the age of 50. The government will contribute a 25% bonus when the savings are put towards a first home or are withdrawn as retirement income after the age of 60. When withdrawn for other purposes, the saver will forfeit the government bonus plus interest, and will also incur a charge.

The Savings (Government Contributions) Bill 2016-17, which will legislate for the Lisa, was introduced to the House of Commons in September 2016. The Lisa is due to launch in April 2017.

Of those respondents that intend to introduce a workplace Lisa, all (100%) think that staff will treat the Lisa as an additional savings vehicle to pension saving. Less than a fifth (18%) of these respondents believe the introduction of the Lisa will cause employees to opt out of their workplace pension scheme, and 85% believe it will increase employee engagement with retirement planning.

Tune in to EB TV at 11am on 29 November for Employee Benefits Wired, where an expert panel will discuss key themes from the findings of the research. Tweet your questions for the panel using #EBWired.