EXCLUSIVE: Almost all (95%) HR and benefits professionals belong to a pension scheme provided by their employer, according to research by Employee Benefits.

This is the highest percentage of a sample to do so since we first carried out this research in 2008, up from 91% in 2014 and 89% in 2008.

The Salary survey 2017, which surveyed 249 HR, reward and benefits professionals in December 2016, also found that of those that do belong to an employer-provided scheme, 18% are members of a defined benefit (DB) scheme, while 85% belong to a defined contribution (DC) scheme.

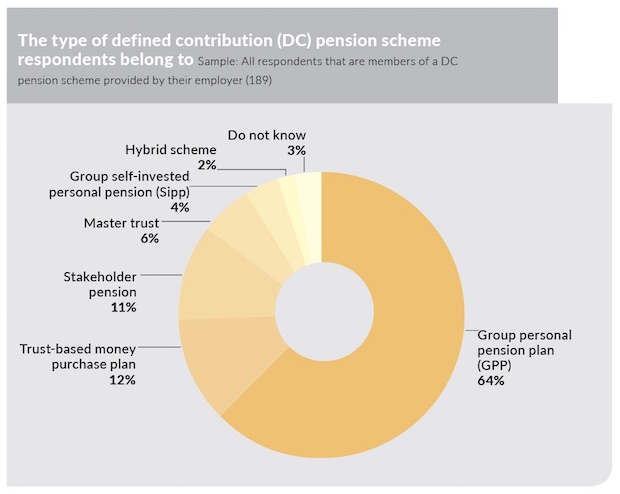

Just under two-thirds (64%) are members of a group personal pension (GPP) plan, while 12% belong to a trust-based money purchase plan, 11% to a stakeholder scheme, 6% to a master trust, 4% to a group self-invested personal pension (Sipp), and 2% to a hybrid scheme.

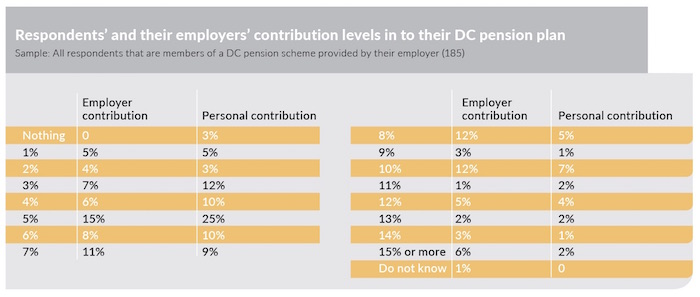

As in 2014, the most common contribution level for both respondents who are active members of a DC scheme and their employer is 5% of salary. The survey also found that 16% of respondents pay 10% of salary or more into their pension. More than a quarter (28%) say their employer contributes 10% of salary or more into their DC pension scheme.

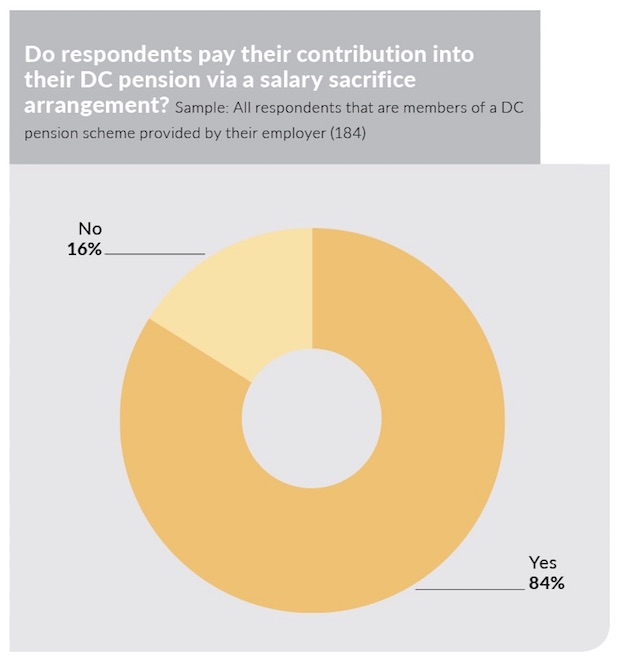

Salary sacrifice remains a popular mechanism for making pension contributions, used by 84% of respondents who are active members of a DC pension scheme.

Click to download the full Employee Benefits Salary Survey 2017.