Employee Benefits Live 2018: Pharmaceutical organisation Mundipharma’s overhauled flexible benefits package offers wider choice to employees.

In a session entitled ‘Building a flexible benefits strategy for the future’, which took place as part of the benefits strategy stream at Employee Benefits Live on Tuesday 2 October, Amy Goodwin, head of reward and wellbeing at Mundipharma, discussed the challenges the organisation had faced and the actions it took to overhaul its offering.

When Goodwin started her role at Mundipharma, one of her initial challenges was to discover why the premium for group income protection insurance was going to increase by 40%. This was the catalyst to take a deeper look into the benefits package, and to start down the road of creating a flexible strategy to suit employees.

Mundipharma is a small to medium-sized organisation, mainly based in Cambridge, and comprising approximately 1,000 employees in a variety of roles, including marketing and sales, laboratory jobs, manufacturing, night shift workers, truck drivers and engineers. Goodwin reported that Mundipharma has an ambition to grow and compete with larger organisations, and that this influenced its need for a refreshed benefits offering.

“We think if we can offer a benefits package and a conversation about culture that [prospective employees] have not had before we might be able to attract those people into our company,” explained Goodwin.

Mundipharma used this opportunity to consider the benefits employees truly value; it also found that it needed to change its culture to one of shared responsibility, rather than one in which the organisation footed the bill and employees did not understand the expense, or the value, of their benefits.

“We didn’t want to spend less, we just wanted to redistribute, realign those insurances to free up money and enable us to spread that investment across our employees,” Goodwin reported.

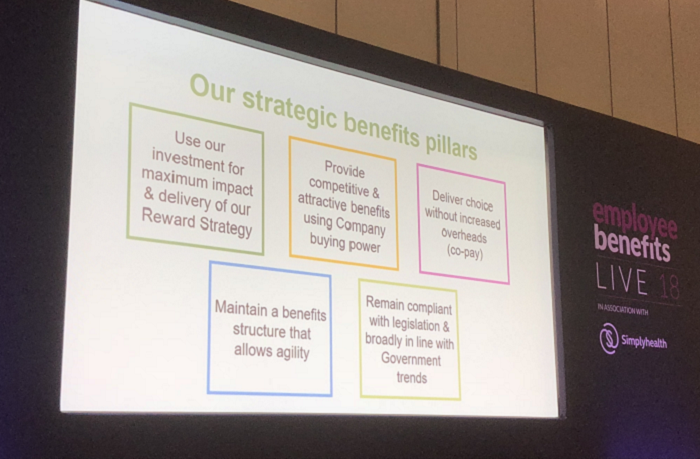

Mundipharma came up with a list of principles upon which to base its new approach. These included: using investment for maximum impact; delivering choice without increased overheads; shifting benefits attitudes without increasing overheads; remaining compliant with legislation; and creating an agile framework.

“For us, this was quite a seismic change, we hadn’t changed our benefits package since 1983, and we were going to lift the whole thing up and give it a shake, so it was a really big change for us,” said Goodwin. “What was important was to get the principles agreed so that we could develop a high-level design.”

The design that resulted consisted of three pillars: health, wealth and lifestyle. Under health, the strategy included medical, dental and optical cover. The wealth pillar covered pensions, life insurance, income protection and critical illness cover. The lifestyle section included gym membership, cycle-to-work programmes, car lease schemes and childcare vouchers.

“These are not groundbreaking developments, but for our people they were, because before they only got their pension, holiday, and death in service,” said Goodwin.

Once Mundipharma had developed its high-level design, it commenced a full consultation with employees. “We needed to rewrite [our benefits strategy] so that it would be agile in the future, but we also wanted to use that consultation to say: ‘this is one way we can do this, and we want to have a conversation with [the employee]’,” explained Goodwin.

“We put a lot of effort into changing our tone of voice. Previously, as the paternalistic employer of the past it would have been very formal, dry, no presentations or interactive discussions.”

The focus for much of Mundipharma’s strategy and communication was around choice, and allowing for the different needs of a wide range of employees. In addition, it was important to help employees understand what their flexible benefits allowance might buy them, and what the value of their benefits was.

The development of Mundipharma’s benefits strategy continued over three years. After choice, Goodwin stated, what employees are most interested in is convenience. “If you place something in front of someone, they start to take up that offer, so we just put in the accessibility.”

The initial design agreed upon by the organisation has continued to influence its benefits strategy as it has developed over the years. In project board meetings, decision-makers discuss industry trends, government legislation, engagement levels and employee suggestions, all within the context of what fits with the original pillars.

“We use the strategic pillars all the time,” Goodwin noted. “They will morph over time, but the fact that we pinned them down really early allowed us to go forward and build the high-level design and have the confidence that, when we did the consultation, the employees were going to be happy.”