By Jim Grant, Senior Product Insight & Technical Support Analyst

The definitions of adjusted income and threshold income used to determine whether, and to what extent, someone’s annual allowance will be reduced can be confusing. Here we try to make sense of it all.

The annual allowance will be reduced for high income individuals from 6 April 2016. Our previous article Tapering of annual allowance for high incomes explains the detail of how it will work. This article explores some of the more practical aspects.

From 6 April 2016, individuals who have 'adjusted income' for a tax year of greater than £150,000 will have their annual allowance for that tax year restricted. It will be reduced, so that for every £2 of income they have over £150,000, their annual allowance is reduced by £1. Any resulting reduced annual allowance is rounded down to the nearest whole pound.

The maximum reduction will be £30,000, so anyone with income of £210,000 or more will have an annual allowance of £10,000. High-income individuals caught by the restriction may therefore have to reduce the contributions paid by them and/or their employers or suffer an annual allowance charge.

However, the tapered reduction doesn't apply to anyone with 'threshold income' of no more than £110,000.

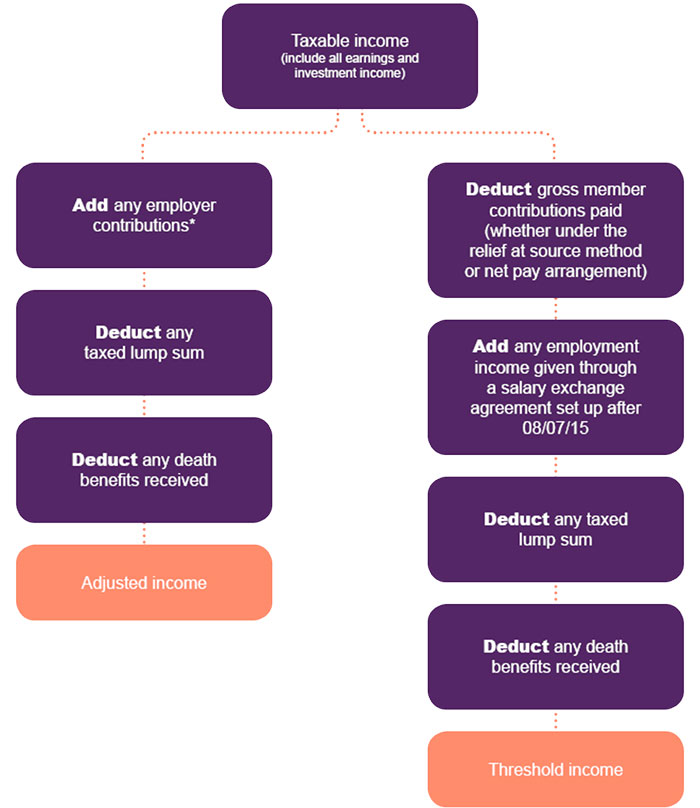

Clearly, the definitions of the two incomes are crucial to understanding whether someone is affected by the tapered reduction or not.

Adjusted income v threshold income

Both include all taxable income. So this is not restricted to earnings – investment income of all types and benefits in kind such as medical insurance premiums paid by the employer will also be included.

The difference is pretty simple; adjusted income includes all pension contributions (including any employer contributions) while threshold income excludes pension contributions.

Unfortunately, HMRC's definitions of adjusted and threshold income (see Tapering of annual allowance for high incomes) tend to cause a bit of confusion because they start with something called 'net income'. A common sense meaning of this would be 'income after tax', but it's not.

Net income in this context is all taxable income less various deductions. The most important (or at least the most common) of these deductions are member contributions paid to an occupational pension scheme, both money purchase and defined benefit, under the net pay arrangement. This is where the sponsoring employer of the pension scheme deducts employee contributions before deducting tax under PAYE.

The other deductions are things like trade losses, share loss relief and gifts to charities. A full list of the deductions can be found at s.23 of the Income Tax Act 2007.

However it all becomes a bit easier if we consider taxable income from a more practical view point.

When someone says 'I earn £x p.a.', they don't usually mean that that's the amount after the deduction of net pay arrangement contributions. We can therefore assume that when someone has earnings of £160,000 and pays contributions of £20,000 under the net pay arrangement, they'll state their earnings as £160,000, not £140,000. The £160,000 includes the pension contributions.

This is therefore a good place to start for calculating adjusted income (which includes pension contributions). For threshold income, all member pension contributions need to be deducted and you wouldn't add in employer contributions.

Example

Phil is a company director and sole shareholder of his own company. His taxable income is £100,000 and he decides to pay an employer contribution of £60,000 (using carry forward to avoid an annual allowance charge).

His adjusted income is therefore £160,000 which would on the face of it trigger a reduction of £5,000 in his annual allowance (half of the £10,000 excess over £150,000).

However, his threshold income is only £100,000 and so the tapered reduction does not apply.

Carry forward

It's still possible to carry forward unused annual allowance from previous years to a year where the taper applies.

However, the amount of unused annual allowance available when carrying forward from a year where the taper has applied will be the balance of the tapered amount.

Money purchase annual allowance (MPAA)

If someone is subject to the MPAA as well as tapering, the taper reduces the 'alternative annual allowance' which applies to any DB benefits they may have. This is the standard annual allowance less the MPAA of £10,000, so currently the alternative annual allowance is £30,000.