Need to know:

- Gamification provides an additional channel through which staff can learn about financial matters.

- Introducing gamification into a financial education programme could help to increase employee engagement with financial wellness, particularly among younger staff.

- Embracing digital game elements that can be accessed on a number of devices can tap into the ways in which today’s workforce chooses to consume information.

There has been a buzz around the use of gamification in the workplace for some time now. Yet this has often been accompanied by a sense that its potential, particularly in the employee benefits space, is yet to be fully realised.

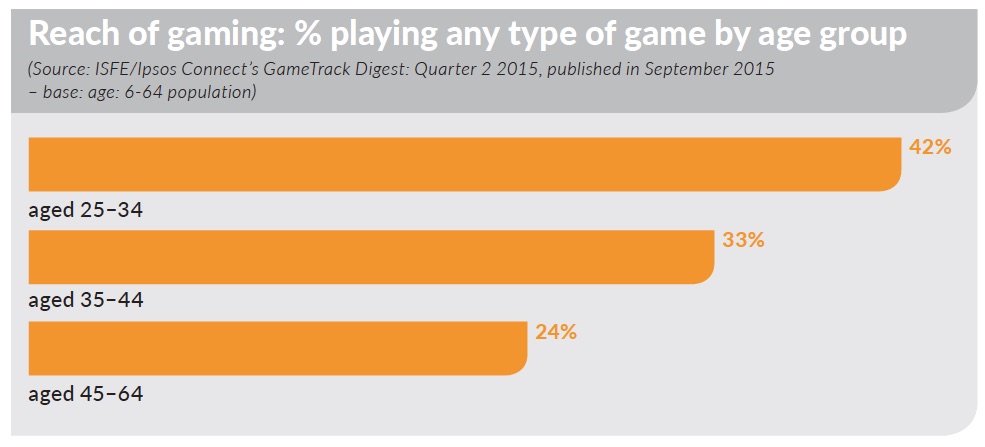

This could be partially attributed to misconceptions that gaming elements, and particularly digital games, only appeal to certain segments of the workforce. Indeed, research published by Penna and Trajectory in March 2015, Big game hunters: why HR directors are missing the target, found that 90% of HR director respondents were unable to correctly identify who plays the most games.

Gaming, in all its forms, is not just the preserve of the young, and alongside the increasing prevalence and sophistication of digital technology, there is a growing awareness that enjoyment of serious and casual gaming spans across the gender and age spectrums.

Andrew Walker, UK practice lead, communications and change management at Towers Watson, says: “The mobile transformation has helped to drive towards gamification because our smartphones have evolved into platforms that we use every day to access information with expanding functionality. We’re used to using these devices in a highly interactive way; we play games and we explore, share and contribute to content.

“Gamification is an important technique as we move through this digital revolution. Big business is starting to wake up to the fact that it has to adopt consumer grade principles when delivering information to their employees, and that means adopting principles from marketing, social media and gaming.”

Exploring alternative avenues

In terms of employee benefits, gamification, the use of game elements and game psychology in a non-game environment, has thus far perhaps been most effectively employed within the health and wellbeing arena, through interactive apps, challenges and wearable devices.

Tobin Murphy-Coles, commercial director and head of software innovation at Aon Employee Benefits, says: “What the health products have done really well is ask people to measure where their fitness currently is, to set some goals and then get rewarded for hitting those goals, and that concept stands absolutely true for financial services.”

Overlaying gamified health elements with financial wellness gaming elements could provide an engaging game environment, as well as a valuable data set, he adds.

Of course, it could be argued that gaming elements have been part of the financial education toolkit for some time now, in the form of pension modellers and interactive, game-based learning. However, by tapping into the potential of popular and digitally advanced tools, from apps through to virtual reality-based game learning, employers could deepen employees’ financial understanding and spark interest among the disengaged.

Karen Partridge, head of client services, UK and Australia, at AHC, says: “While we shouldn’t have any preconceptions about what the audience [for gamification] is likely to be, it is likely to engage a younger demographic where other things can’t.”

Exploring alternative and fun methods of disseminating information and increasing awareness of financial matters can form part of a proactive approach to supporting staff with financial wellness, whether that be coping with debt, getting on the property ladder or saving for retirement. Andrew Woolnough, value proposition director at Willis Employee Benefits, says: “We know that people are stressed about financial matters so let’s think of new and innovative ways to help people save. It’s about trying to get hold of a new generation to get them in the habit of saving.”

Offering gamification tools can also provide another way of learning, expanding the educational channels within a workplace financial education programme and enabling employees to take advantage of their preferred method for consuming content. “There are three elements to [offering gamification]: employees should be able to play it competitively; play it non-competitively; or switch to not playing it at all and just consuming [information] in a [traditional] way,” says Murphy-Coles.

Technical hurdles and opportunities

The ability to access digital gaming tools on a number of devices also allows employees to engage with these how and when they want to. This could also be useful for staff across multiple locations and functions, says Partridge. “Having something online that everybody can access on a mobile device opens it up to everyone in the organisation, you’re not excluding anyone by virtue of where they happen to work and what tools they’re given to do their job.”

However, if digital gamification is to have a wide impact, employers must ensure that all staff have access to a device on which the gamification tool runs, says Murphy-Coles. While some gaming elements can be introduced into strategic areas cost-effectively, the lack of a digitally enabled platform on which to base organisation-wide gamification could present a challenge for some businesses. Walker explains: “Not every corporate has the digital ability to be able to develop content that is completely device agnostic, so that it renders on a smartphone, tablet or desktop.”

Sustained engagement

Tailoring gamification tools to specific organisational needs can increase their effectiveness. This could include: establishing clear objectives for the tool’s use and its place within the wider financial education strategy; alignment with corporate values; examining what motivates the target demographic, such as the use of feedback, reward and competitive elements. In addition to being user-friendly and fun, gamification tools should also point employees towards support mechanisms and resources, should they wish to access further information or take action.

“It’s important that gamification isn’t just fun for the sake of it,” says Walker. “It’s applied fun and should be a balance between game mechanics and a deliberate approach to meet objectives with ongoing measurement and evaluation.”

Continuing to meet target objectives might necessitate refreshing the way gamification is applied as employees’ requirements evolve. An Coppens, design expert and chief game changer at Gamification Nation, says: “To keep engagement with a long-term strategy, [employers] need to be more creative than just having one solution to fit everything; keep an eye on what’s still working and what’s changing.”

Usage data and staff feedback can highlight areas that require attention and indicate the financial issues that are most pressing for staff, information that can, in turn, be used to further shape financial education and communication strategies.

While metrics and feedback could help employers develop the content of financial education schemes, employee demand could lead to an increased number of firms offering gamification as a workplace tool. Research conducted in July 2015 by US-based gamification firm Badgeville found that 73% of 22 to 35-year-old respondents and 56% of 36 to 55 year olds expect gamification programmes to be offered in a modern organisation. Murphy-Coles adds: “From what we’re observing in the small groups of people already using it, and from the way they’re talking about it on social media, I think gamification will almost become viral and it will be employees pushing employers to use it.”

Viewpoint: Consider the key elements for effective gamification design

Viewpoint: Consider the key elements for effective gamification design

Gamification is ‘the use of game design elements in non-game contexts’ (From game design elements to gamefulness: defining gamification, Deterding et al., 2011). By drawing upon game design elements, mechanics and techniques, organisations hope to engender, in work, the type of experience that we find motivating, engaging and fun when we play games. So, ultimately, it is about engaging and motivating people, which is why gamification is being used in diverse contexts such as learning and education, and marketing.

A useful foundation for gamification design can be to consider the nine Ps:

Purpose is the articulation of the organisational objective that you are trying to achieve. Personal motivation is about making the experience meaningful by tapping into the intrinsic motivation of the players.

Performance is concerned with the judging of success, for example, behaviour change, and giving feedback.

Progression is designing suitable levels of challenge for players of different abilities, and participation is about ensuring the game appeals to players, for example, by targeting different types of fun.

Partnerships considers the ways players might work together, such as collaboration or competition, and player potential is what you aim to unlock.

Player is about understanding the target audience and also making choices about their role in the game, for example, do they play as themselves.

Finally, good gamification design is about getting right the politics in terms of the fit with the workplace and its culture.

Brian Burke, an analyst at Gartner, opines that: “Gamification has tremendous potential, but right now most companies aren’t getting it right” (How Gamification Motivates People to Do Extraordinary Things, 2014). Yet, there is increasing evidence that gamification does work so what does it make it right? Regrettably, there are no easy answers but good gamification design will certainly contribute to the success of its use in the workplace.

Dr Penny Simpson is principal lecturer at Brighton Business School

Kingfisher uses gaming app to engage staff with long-term saving

Kingfisher uses gaming app to engage staff with long-term saving

In November 2014, the Kingfisher Group launched an app, Bolt to the finish, to encourage its 36,000 employees to engage with retirement saving.

The app is part of an integrated five-year campaign, Saving for your future, which was developed together with agency Teamspirit following the successful auto-enrolment of 14,000 Kingfisher Group staff on 31 March 2013. The campaign includes the introduction of four new educational modules each year, with topics ranging from retirement provision to saving through the approved share schemes the group offers to its employees. With a wide age demographic and employees located across multiple sites, the campaign aims to support all elements of its workforce and ensure they have the knowledge to make informed decisions around long-term saving.

The app features characters from the Bolt family, which were first introduced as part of the group’s auto-enrolment campaign. The characters, and other imagery within the game, draw on products familiar to the group, which includes B&Q, Screwfix and KITS, such as screws, nuts, bolts, glue and tape measures.

Dermot Courtier, head of group pensions at Kingfisher, says: “Throughout the education programme, we have kept alive the Bolt family because the feedback we received from our employees indicated that they were starting to identify the Bolt family as retirement messages.”

During the game, users select to play as a member of the Bolt family, overcoming obstacles to collect gold coins. Upon completion, as well as seeing where they rank on the leader board, players are directed towards the pension trustee website and educational material about saving.

With 25% of its workforce under the age of 25, the Kingfisher Group saw the app as an opportunity to engage younger employees with saving. It also aims to encourage staff to increase their pension contributions so that they become used to the higher levels ahead of the compulsory minimum contribution increases that will come into effect under the next phase of auto-enrolment.

Banafsheh Ghafoori, pensions technical and communication manager, says: “We understand not everyone has one way of learning or absorbing information. We felt that by introducing this app it would be more effective at reaching younger employees than sending them communication by post. It brings out a level of fun.”

The app has been positively received by staff and has had an impressive impact; 78% of players said that the app encourages them to think about saving for the future, and there has been a 20% increase in the number of staff choosing to save into their pension at the maximum contribution level.