Six out of 10 respondents said there would be a significant difference in the number of employees who would consider joining, or staying in, a defined contribution (DC) pension scheme or who would pay higher contributions if the qualifying default fund secured a guaranteed pension income building up year on year, according to research by the Association of Consulting Actuaries (ACA).

Its research, The unfinished agenda: growing workplace pensions fit for purpose, which forms part one of the ACA’s 2013 Pension trends survey, gathered responses from 308 employers with more than 430 pension schemes.

The research found that, while smaller employer respondents expressed no view on the principle of the government’s proposed defined ambition pensions, respondents that employ 500 or more employees were supportive of the legislation to permit the following designs: core defined benefit (DB) schemes with no requirement to index benefits on an annual basis; an option for a DB scheme where employers could automatically convert leavers’ benefits to a DC pension (and possibly retirees’ benefits to an annuity); and an ability for employers to adjust scheme pension age in line with changes to the state pension age or some other objective index.

It also found that six out of 10 respondents oppose the government taking a role in encouraging consolidation of schemes in the pensions market, with smaller organisations the most strongly opposed to such an initiative.

The research also posed questions about auto-enrolment. It found:

- Two-thirds of respondents intend to change their pension arrangements as a consequence of auto-enrolment.

- More than three-quarters of larger employers (with 1,000 or more employees) said they would not offer a multi-employer scheme, whereas more than three-quarters of smaller employers (499 or fewer employees) agreed that a multi-employer arrangement was either likely or possible.

- Just over half expect to enrol all eligible jobholders into either an existing or new DC scheme, while a fifth expect to enrol employees into the National Employment Savings Trust (Nest) or a new multi-employer scheme.

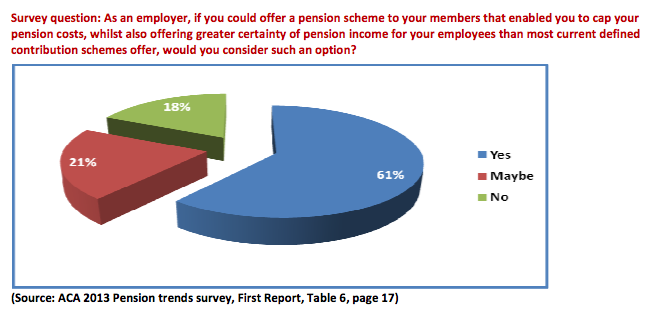

Andrew Vaughan (pictured), chairman of the ACA, said: “For more than a decade, it has been evident to me that employers, many discouraged by the mounting cost and risks involved in offering final salary schemes or concerned by the volatile outcomes of traditional money purchase schemes, have been searching for new pension models that are fit for purpose; models that would enable them to cap their costs while also meeting their employees’ legitimate calls for greater certainty over the pensions that are delivered.

“The proposals contained within the government’s defined ambition paper, in my view, address the unfinished agenda and provide a way forward towards both reshaping and reinvigorating workplace pensions.

“They offer a range of new options that will be attractive to different employers and their employees, all part of a new framework that looks beyond the current regulatory extremes of final salary and money purchase.

“This survey gives both encouragement and an early indication of the degree to which employers of different sizes agree with the defined ambition flight-path.

“We urge the government to act quickly and decisively to put a legislative and tax framework in place that would enable such schemes to become reality.”