Respondents to Employee Benefits/Capita Pensions Research 2013 that have auto-enrolled staff into a workplace pension are more likely to pay in a 1% employer contribution than those still to go through auto-enrolment.

According to the research, conducted among 370 HR and benefits managers, 21% of those that have auto-enrolled staff are paying a 1% pension contribution, but only 7% of those still to auto-enrol pay in at this low level.

In turn, 23% of those still to auto-enrol pay a 5% employer contribution, but just 10% of those that have auto-enrolled pay in this much.

Under auto-enrolment rules, employers are required to pay 1% until 2017, while the employee pays in 1%.

Between 2017 and 2018, employers will have to contribute 2% while the employee pays in 3%.

From 2018, the employer contribution rises to 3%, with the employee paying in 5%.

The proportion of employers using qualifying earnings (as defined under auto-enrolment) on which to base employees’ pension contributions is 13%. This is more than three times the proportion reported in 2012 (when 4% did so), in line with the increasing number of employers auto-enrolling their employees.

Accordingly, the proportion of employers using basic salary alone on which to base their employees’ pension contributions has fallen from 70% to 65% over the last year.

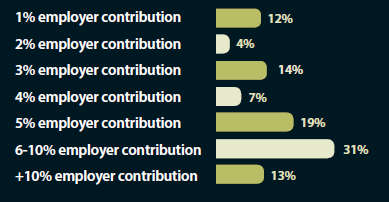

Level of employer contributions

Read the full version of Employee Benefits/Capita Pensions Research 2013